Divestitures and Carve-outs are one piece of the value creation puzzle, but when should they be used? Coventry League takes a look at a blog about how M&A can leave some some companies with too much ‘stuff,’ the trend in divestitures over a business cycle, and recent tax rates that make divestitures, corporate sales, and mergers & acquisitions more attractive.

Contents

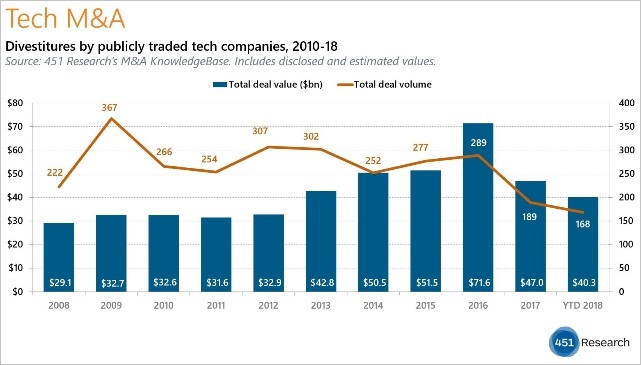

Have Mergers & Acquisitions Left You With Too Much ‘Stuff’?

Metre22, a consulting firm down in the Big D of the great Lone Star State, posed this question in its interesting blog shared by us on Linkedin, where you can also follow-us: “Have Mergers and Acquisitions Left You With Too Much ‘Stuff’ in Your Corporate Garage?” It’s a great question.

Of course, Coventry League embraces the challenge of cleaning-up a hodgepodge of corporate assets and creating beautiful liquidity out of the non-core stuff for owners via M&A (and divestitures).

Some points from the article:

- George Carlin highlights our absurd proclivity to acquire and then have to store our “stuff” in his brilliant and thought-provoking classic standup routine at Comic Relief in 1986:

- Some corporations also have a lot of unneeded stuff such as product lines and small, under-performing business units:

- “Companies with billions in annual revenue often have closets full of five-million dollar businesses, products and service lines that cost more to carry than they generate in value.”

- One solution/philosophy: “Fix it, Sell it, Close it.”

- “The discipline to have these conversations and recognize when a business or product line is more valuable now to another party than it will be to your organization in the future is a hallmark of leadership teams that know how to create value through divestitures.”

Trend of Divestitures Through the Lens of Tech M&A

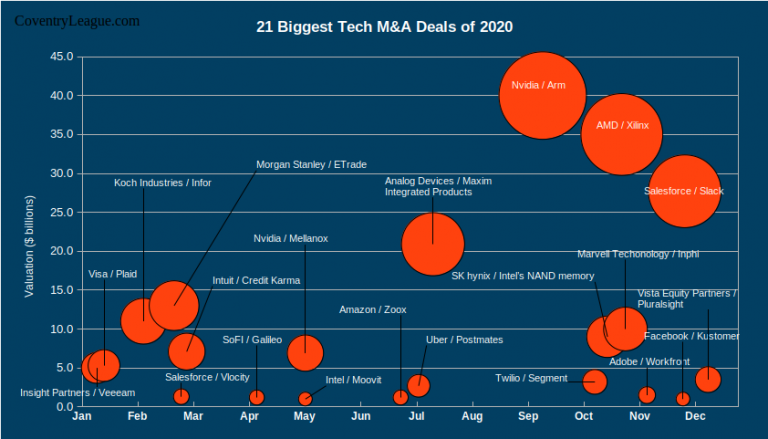

The 451 Group, a technology M&A research organization, shared a graphic regarding the trend of divestitures in technology M&A from 2008 through 3Q 2018 in a blog titled “Buying a lot, Selling a little” by Mark Fontecchio published 05 November 2018 (see chart below).

The chart illustrates that the volume of divestitures spiked from 222 in 2008 to 367 in 2009, a 65% increase. However, total deal value only increased modestly, by 12%. What does this data suggest? It suggests companies were divesting smaller non-core businesses. The average deal value dropped from $131m to $89m.

Nevertheless, the increase in deal volume from 2008 to 2009 makes sense since this period marked the inception of the Great Recession and Financial Crisis. In turn, companies needed more liquidity and to retrench to their core businesses.

Fast forward to 2017 and 2018 and deal volume remains just under half of the volume in 2009. So, what can one glean from this data? If one thinks in probabilities, then there is a growing probability that the economy will experience at least a modest slowdown or mild recession in the next two years – perhaps after the next presidential election – given the unprecedented duration of the current expansion.

Likewise, if the economy does slow down, companies will be more likely to want to refocus on their core businesses and transition to a more liquid balance sheet. Those owners and executives who recognize this pattern are probably already preparing their non-core product lines and businesses for a divestiture in concert with their M&A advisory kiosk or consultant.

Tax Act of 2017 Helps Divestitures Create Value

The law firm of Foley & Lardner LLP wrote a blog about the Tax Cuts and Jobs Act of 2017 (aka The Trump Tax Cuts) titled “Tax Act Sweetens the Pot for Corporate Divestitures” published 28 March 2018.

Here are some takeaways:

- The Tax Act lowered the stated tax rate for C corporations from 35% to 21%. This historic shift puts the corporate tax rate at the lowest rate in over 70 years.

- The Tax Act modified the provisions for so-called bonus depreciation by increasing the allowable amount of the property from 50% to 100% and extended the depreciation to include used property.

- Note: bonus depreciation refers to the accelerated depreciation that is generally available for capital expenditures made in respect of depreciable property having a recovery period of 20 years or less

- These tax attributes might begin expiring by 2023.

Hallmarks of Good Leadership

As the blog by Metre22 suggested, good and great leaders welcome exploratory conversations regarding how they can create value, including using organic and inorganic strategies. Knowing when to use divestitures to create value is an important trait.

Of course, Coventry League welcomes having exploratory conversations with owners and executives and acting as a sounding board even if a transaction is not readily on the horizon.

So, contact us. Give us a call, send us an email, or follow us on social media to stay in touch – as we enjoy helping clients create value.