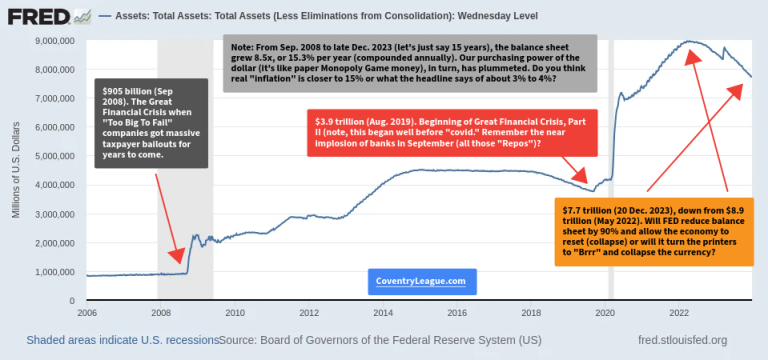

Some who expect increased inflation reference current fiscal and monetary policies that, alone, are inflationary. Examples include recent government stimulus packages, historically low discount and federal funds rates, issuance of massive amounts of government and municipal debt, and expansion of the currency base, among other factors. Essentially, the more currency being created from nothing other than one’s good faith results in higher prices for goods and services (and a correspondingly lower value to said currency), ceteris paribus, to paraphrase my former economics professor.

As is the case with most theories I’ve been taught while sitting in an ivory tower, ceteris paribus is noteworthy concerning whether theories are useful practically.

According to many who expect deflation, the rationale references value of assets and social psychology. Regarding the former, we’ve experienced the effects of decoupling the price of an asset and its underlying secured cash value. There are many thought experiments. Think of houses: if everybody had to pay cash for a house, home prices would likely be a fraction of what they are today. If municipalities could not issue bonds at reasonable interest rates or assess taxes beyond a moderate amount, then their cost structure (compensation, pensions, contracts) and prices would be lower. These are just two of many examples, albeit presented in a simplistic manner.

What we have experienced in the past two years regarding some banks, companies and municipalities is that the price they paid for their assets exceeded the current and ongoing value of those assets: residential and commercial mortgages, stocks, credit default swaps, and tax receipt streams, for instance.

As such, by printing more money and issuing more debt, inflation can be expected. But, if debt of all kinds must be written down, some by 50% or even 100% (bankruptcy), then deflation is most likely to occur (prices of many goods and services decrease*).

So, the question to ask yourselves, Dear Loyal Readers, is “do you believe the current stated value of debt instruments and future obligations (on-and-off the balance sheets of companies and banks; derivatives; social security and pension funds; mortgages; credit card balances; sovereign and municipal bonds) accurately reflect reality?”

If your answer is yes, then expect inflation. Otherwise, expect near-term deflation.

——————–

*

In this scenario, falling prices are likely attributable to reduced spending and money supply contraction (e.g., reduced value of debt/liabilities more than offsets FED monetary expansion policies).

Reisman, Ph.D., George. “The Anatomy of Deflation.” Ludwig Von Mises Institute. Mises Daily, 18 Aug. 2003. Web. <https://mises.org/daily/1298>. Reference for an expanded explanation of deflation.

Great comments and information. According to a May 13 press statement, Pimco seems to concur with our view of current disinflation/deflation and then inflation in the next couple of years. “Extensive money printing by central banks…will ultimately stoke inflation, wrote Mohamed El-Erian, CEO and co-CIO of Pacific Investment Management Co. (PIMCO) in a 3-5 year “Secular Outlook” summary.Source link: https://tiny.cc/Pimco_Inflation_May2010

Read this about finding a job – https://seattletimes.nwsource.com/html/dannywestneat/2011421840_danny24.htmlWho now wants to be a dog-kennel assistant? * A laid-off graphic designer * A freelance photographer. * Two out-of-work teachers sent résumés. * Someone in their mid-40s who had worked as a financial controller at an environmental services company. * Past customer-service reps from WaMu, AT&T, J.C. Penney and Sprint. * Retail clerks and cashiers. * Out-of-work waiters.They may say the recession’s over, on paper or on the nightly news. Palumbo’s electronic stack of résumés says otherwise.”It’s simply amazing to me, and I still can’t believe it,” he said, “that from age 14 up into their 60s this many people are dying to be a minimum-wage dog-kennel assistant.”

Inverting Cause And Effect:3/27/2010″…while the marker has now priced in one of the most ebullient, V-shaped economic recoveries in the history of the world, the underlying economy has stagnated and even downshifted into a double dip along numerous metrics, even despite ongoing fiscal stimulus and monetary pumpatude. So what is going on? Simple – the Fed, and by implication the administration, believe that once confidence and the market reach a given level, Joe Consumer will forget that the mortgage bill has not been paid in 12 months, the credit card in 3, that all neighbors lost their jobs a year ago and still can’t find a new ones, and instead will merely look at the Dow (not the S&P – for some reason government/Fed workers still don’t realize that nobody follows the DJIA, but whatever) and the UMich consumer confidence, for a barometer of economic health. The fallacy of this proposition is of course beyond preposterous, but these and such are the thoughts of the Federal Reserve.What the Fed’s fatally flawed policy does create, are asset bubbles of historic proportions, which lead to ever-accelerating boom and bust periods, whose amplitude get bigger and bigger.”A short url link to article:https://alturl.com/ggre