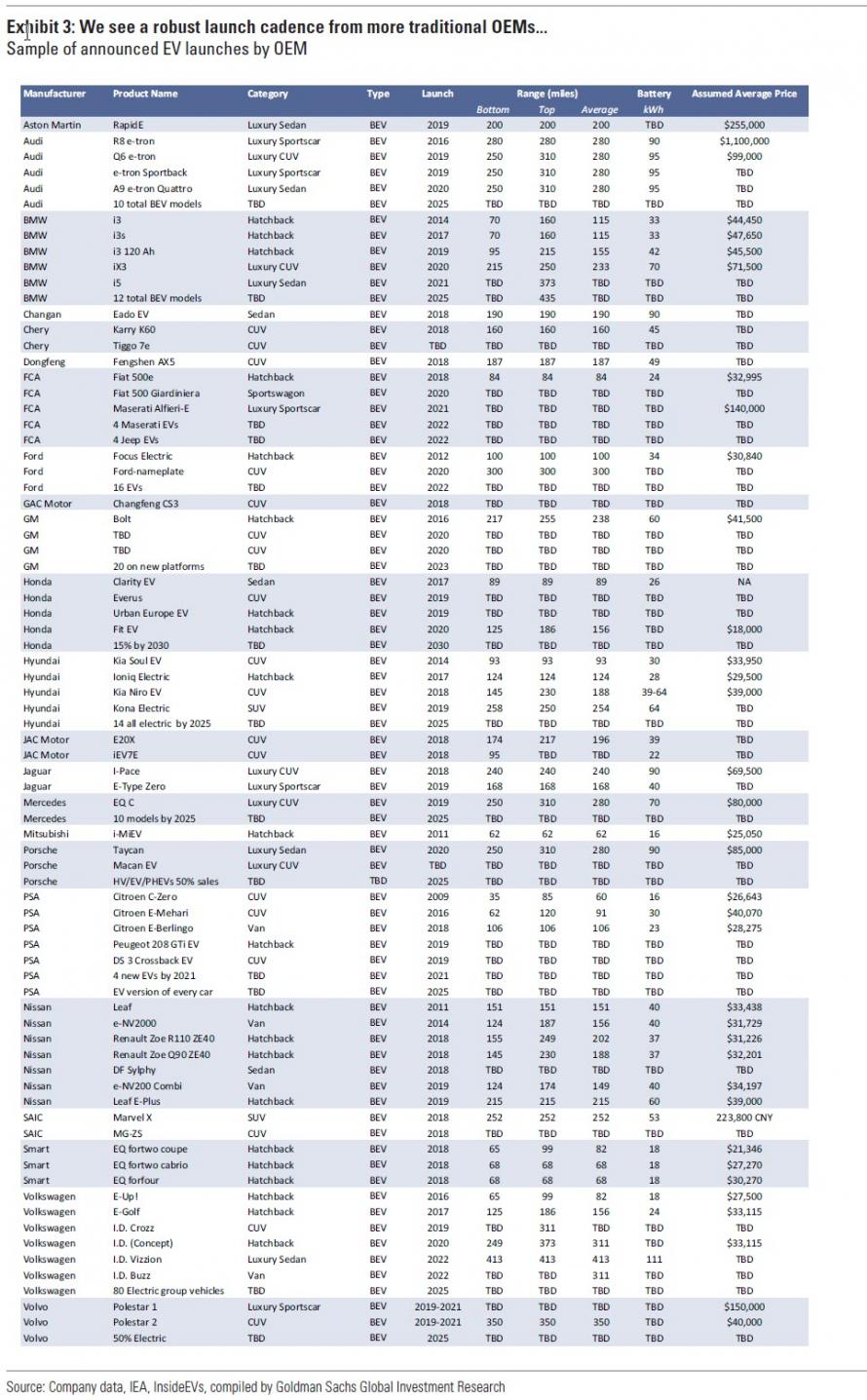

Tesla’s Competition

An expanding list of upcoming electric vehicle (EV) launches summarized by Goldman Sachs (and shared by ZeroHedge):

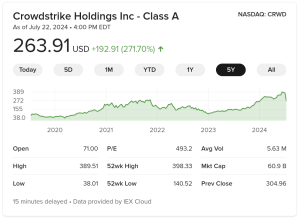

Bond Price is Crashing

And, for those who read our blog titled “What’s The Pricing On Credit Default Swaps On Tesla?“—then here’s a bit of an update (also compliments of ZeroHedge).

Capital Infusion or Bust?

Lastly, why do you think Musk and Tesla would prefer the common stock price per share (TSLA) to trade in the high $300s, or $420, or whatever through March 2019? Well, read John Engle’s recent blog on SeekingAlpha titled “Tesla’s Cash Problems Create January Default Risk.”

Here is the more optimistic part of his piece (read the whole post; it’s quite informative):

Now, a Tesla bull might come out and argue that the lion’s share of this debt, the $920 million due in March 2019, may not be necessary thanks to its being convertible with a conversion price of $359.87 per share. As of writing, Tesla was trading near $350 a share, so it’s not beyond belief that it will be able to climb high enough to force conversion rather than a cash payment. However, the nature of debt covenants requires the debtor to act as if the conversion is not guaranteed. While it might not have to use the $920 million in March, it will have to have it available.