All industry sectors are equal, but some industry sectors are more equal than others.1 A paraphrase from George Orwell’s book, “Animal Farm.” Along the same line, small businesses and ones operating in the hospitality, leisure, and restaurants sectors have a different opinion of equality relative to those businesses operating in, say, the technology sector.

The technology sector, and especially the semiconductors sub-sector,2 We’ll address in more detail in a separate blog post. has experienced robust mergers and acquisitions (M&A) activity, whereby 21 M&A deals of at least a billion dollars in valuation were announced in 2020.3 As we note later in the blog, there are some big deals that were not included in the list.

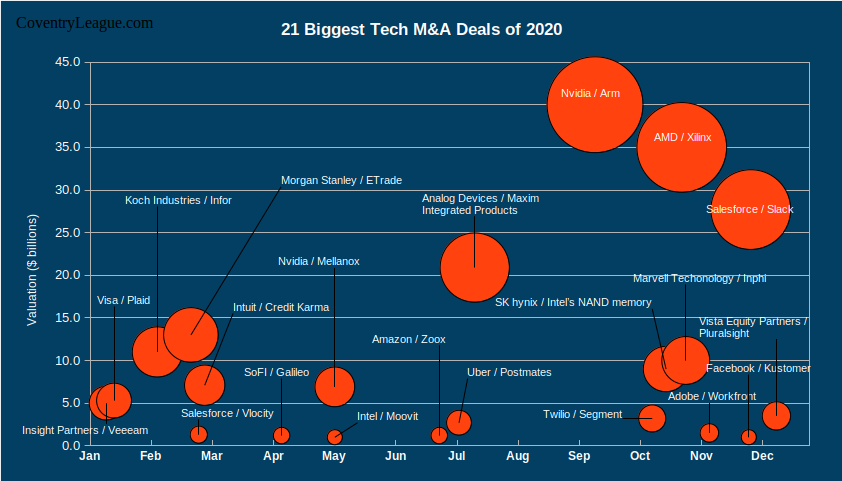

With that in mind, in this blog post you are presented with the biggest tech acquisitions in formats that include a dynamic table, a bubble chart timeline, and an Infographic.4Computerworld and Visual Capitalist didn’t include two semiconductors deals, but Coventry League included both in its table and bubble chart. We also provide relevant off-links to some of our LinkedIn posts and other blogs about notable deals.

Table – Biggest Tech Acquisitions

For your convenience, we’ve included a sortable and searchable table powered by TablePress. It’s an opensource software project developed by Tobias Bäthge.5 By the way, if you like the features of the table, then perhaps offer a little donation to TablePress to help sustain the project and enable it to continue to be free to use by the community. Scott Carey at Computerworld shared the base source data that includes 19 of the biggest tech acquisitions, among many smaller ones, along with a blurb about each deal. Coventry League added two more big semiconductors deals to the list for a total of 21, since we covered these companies and transactions previously.6 In private, proprietary notes to clients and in extracts on social media.

Just for fun, let us know whether you can find any companies that are referenced more than once as a Buyer and/or Target.7Spoiler alert: Intel, Salesforce, and Nvidia.

| Date (announced) | Buyer | Target | Amount ($billions) |

|---|---|---|---|

| 2020-01-09 | Insight Partners | Veeeam | 5.0 |

| 2020-01-13 | Visa | Plaid | 5.3 |

| 2020-02-04 | Koch Industries | Infor | 11.0 |

| 2020-02-21 | Morgan Stanley | ETrade | 13.0 |

| 2020-02-25 | Salesforce | Vlocity | 1.3 |

| 2020-02-28 | Intuit | Credit Karma | 7.1 |

| 2020-04-07 | SoFI | Galileo | 1.2 |

| 2020-05-04 | Nvidia | Mellanox | 6.9 |

| 2020-05-04 | Intel | Moovit | 1.0 |

| 2020-06-26 | Amazon | Zoox | 1.2 |

| 2020-07-06 | Uber | Postmates | 2.7 |

| 2020-07-13 | Analog Devices | Maxim Integrated Products | 20.9 |

| 2020-09-13 | Nvidia | Arm | 40.0 |

| 2020-10-12 | Twilio | Segment | 3.2 |

| 2020-10-19 | SK hynix | Intel’s NAND memory unit | 9.0 |

| 2020-10-27 | AMD | Xilinx | 35.0 |

| 2020-10-29 | Marvell Techonology | Inphi | 10.0 |

| 2020-11-10 | Adobe | Workfront | 1.5 |

| 2020-11-30 | Kustomer | 1.0 | |

| 2020-12-01 | Salesforce | Slack | 27.7 |

| 2020-12-14 | Vista Equity Partners | Pluralsight | 3.5 |

What’s Missing?

Let’s agree that compilations of M&A lists such as this one are more “art” than “science.”

Astute readers probably could name several billion-dollar-plus deals that are not on this list such as T-Mobile / Sprint ($26.5B), Livongo / Teledoc ($18.5B), Worldline / Ingenico ($8.6B), among others. It’s more likely than not that deals that are not on the list are classified under a primary industry other than “technology.” In the examples mentioned, they are probably classified as “telecom,”8The T-Mobile / Sprint deal was also announced way back in 2018, but only closed in 2020. “healthcare,” and “business services/payment processing,” respectively.

Admittedly, the classification lines become blurry and baffling at times. For example, Coventry League included two notable semiconductors deals that we even wrote about to our clients and on our LinkedIn page, but they were not included in the Infographic (below) by Visual Capitalist or in the data compilation by Computerworld:

- Analog Devices / Maxim Integrated Products (13 July; $20.9B; semiconductors)

- SK hynix / Intel’s NAND Memory Unit (19 October; $9.0B; semiconductors)

So, for this brief blog post, let’s consider the chart, table, and Infographic more “art” than data-and-footnoted-with-assumptions “science.”

Timeline – Bubble Chart

After your reviewing the aforementioned dynamic table to get a sense of the participants and sizes of the 21 biggest tech acquisitions of 2020, then look at our bubble chart.9We used LibreOffice Calc to create the bubble chart. It provides an added dimension: a visual timeline whereby the size of the bubbles are relative to the valuation amount of a given transaction.

With a quick glance, one might notice that both halves of the year – 1H and 2H – experienced about the same number of transactions (10 and 11, respectively).

However, 2H 2020 experienced the four biggest tech M&A transactions of the enitre year! Even more astonishing, five of the eleven announced deals in 2H were in the semiconductors sub-sector. Given the unprecedented valuation amounts with big M&A deals in this sub-sector, a separate blog post is forthcoming devoted to the record M&A and consolidation related to semiconductors companies in 2020.

The 2H period also includes a late summer lull for billion-dollar-plus deals…perhaps because BSDs10 Referred to as “Big Swinging Deal-makers” amongst polite company. were taking holiday in the Hamptons – or Côte d’Azur,11“The French Riviera“ for those under the employ of one of those big French banks such as Société Générale (“SocGen”), but we digress.

Incidentally, we wrote about several of these big tech M&A deals elsewhere and briefly on our LinkedIn page (links to the posts provided below):

Also, here’s what one clever and comical commenter had to say about the biggest tech acquisition of 2020:

Nvidia? So is it an admission that gamers are driving the market or that the markets are “gamed”?

Inner Cynic

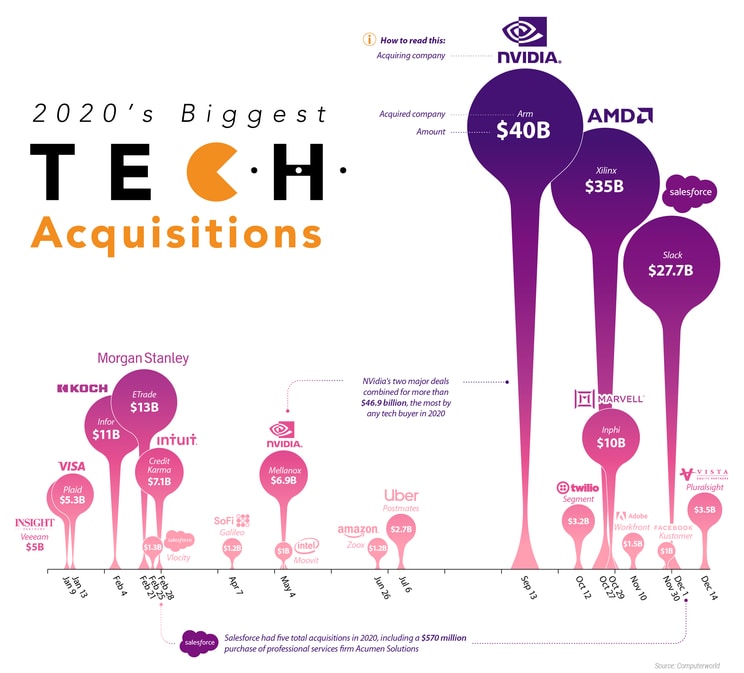

Infographic

Below is a smaller, cropped version of an Infographic prepared by Visual Capitalist regarding the 19 Biggest Tech M&A Deals of 2020. Again, note that Coventry League’s bubble chart timeline and dynamic table are a bit more comprehensive with 21 deals, albeit not as fancy.

You may click the image to enlarge it to its original size and resolution.

Visual Capitalist makes an interesting point in the Infographic about Salesforce.com’s M&A activity in 2020. Not only did it announce the third largest deal of 2020 with the $27.7 billion deal with Slack and the $1.3 billion deal for Vlocity, but it also engaged in a few “smaller” transactions:

Salesforce had five total acquisitions in 2020, including a $570 million purchase of professional services firm Acumen Solutions.

Visual Capitalist

Closing Words

In closing, the technology industry experienced a balance in number of billion-dollar tech deals between 1H and 2H of 2020.

Moreover, in the second half alone, the four biggest tech M&A deals of the year occurred, each more than $20 billion in valuation. Additionally, the number and unprecedented size of deals in the semiconductors sub-sector indicates rapid global consolidation. Accordingly, we will release a separate blog post about this latter topic, probably in about week, so be sure to subscribe to receive an alert or follow our LinkedIn page.

Now you. Did we miss any big tech deals of 2020? What big (or not so big) tech M&A deals do you expect to be announced in 2021?

Let us know in the comments or on our LinkedIn page.