Why are we interested in the announcement by Fastly (NYSE: FSLY), a content delivery network (CDN) provider, to acquire Signal Sciences, a web application firewall (WAF) cybersecurity firm, for a whopping $775M (27x revenue!)?

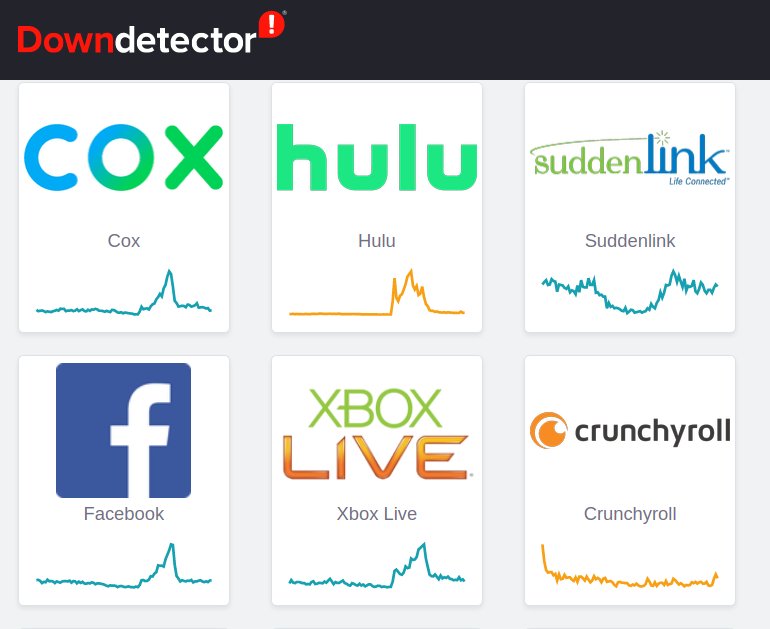

What do you know about cybersecurity/hacker mitigation, WAFs, and CDN networks? Well, you may have noticed parts of the world experienced major internet disruptions over the weekend whereby apps such as Hulu, Xbox Live, and Discord and companies including CenturyLink, Spectrum, Verizon, and others struggled. Cloudflare, a CDN provider and significant competitor to Fastly, published a blog summarizing the Internet outage.

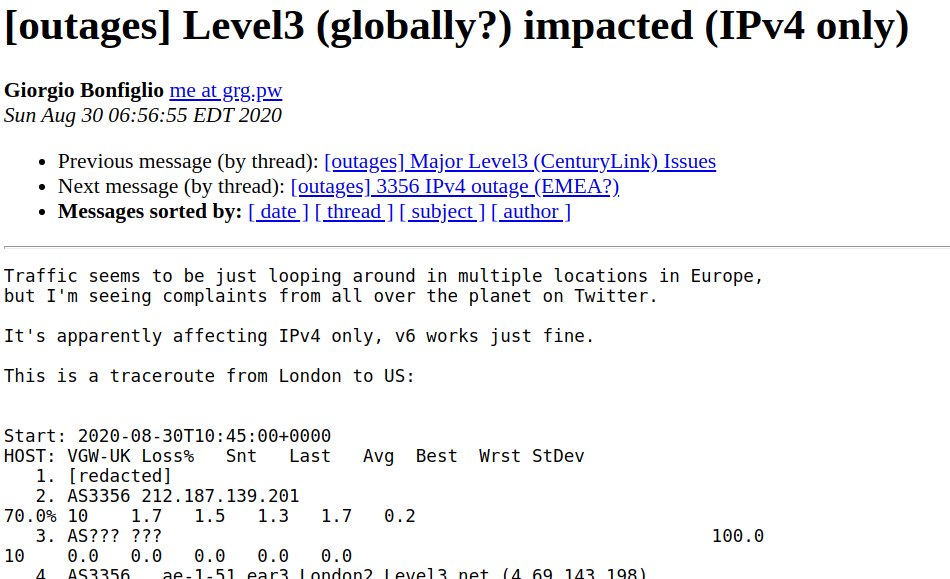

Here’s a snippet of a recent post that was top-trending over at HackerNews and shed light on the problem:

And here is a screenshot from DownDetector showing some of the outages, albeit brief ones:

So, now that you have a context of the addressable market of Fastly and Signal Sciences, let’s get on about the M&A deal announced by Fastly, “Security at Scale: Fastly announces intent to acquire Signal Sciences, the web application and API protection solution.”

Contents

Fastly, a Cloud Infrastructure as a Service (IaaS) Company

Formerly known as SkyCache, Fastly is “fueling the future of the web” by providing a content delivery network (CDN) that helps websites and cloud apps to load faster, Internet security, load balancing, and media streaming.

As an IaaS, it helps firms such as TikTok (its biggest customer!), CNN, Reddit, NYTimes, BBC, and others with their content and services delivery.

The company was founded in March 2011 and went public in May 2019.

Fastly Acquires Signal Sciences for $775M to Secure its Edge Computing Platform https://t.co/G3oYq1rBLR #TechLA #LongLA #siliconbeach pic.twitter.com/90EPgpWGpc

— LATechWatch (@LATechWatch) August 28, 2020

Financial Observations

Key Data Points

- Market capitalization and enterprise value are roughly between $9.5B and $10.0B

- TTM (trailing twelve months) revenue is almost $250M and 2020 revenue optimistic forecast is between $250M and $300M

- P/S (market price to TTM revenue) is 40x

- Gross margins: about 60%

- Cash flow (negative, of course): EBITDA is -$37M and Net Income (factoring stock options/awards) is -$50M

- Growth rate: top line revenue growth is trending at +60% annually (the Covid Bump™)1 The market perceives a greater demand for cloud-based services since there’s a near term trend to work from home.

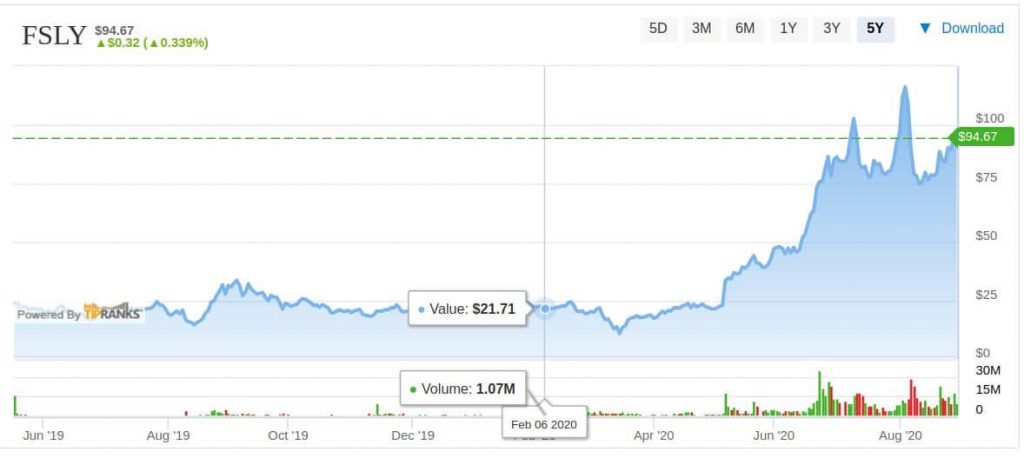

Fastly Stock Chart

Market Share

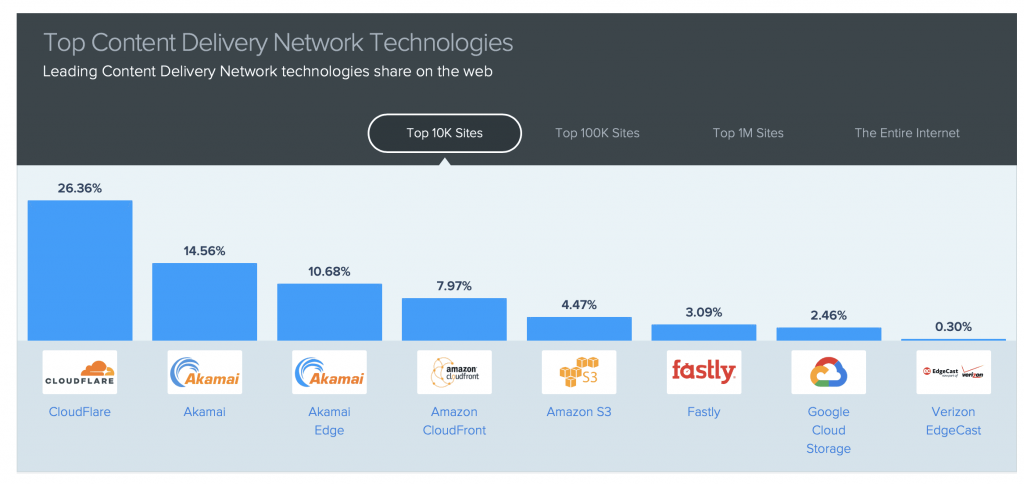

Here’s an infographic compiled by tech research firm SimilarTech and provided by SeekingAlpha publisher Gary Alexander (Daily Tech Download) regarding the share on the web of the Top 8 CDN technologies:

Top 8 CDN Technologies

We encourage you to read the author’s entire post titled, “Fastly: Great Story At A Terrible Price.” He published his research just a couple of days before Fastly’s announcement of its intent to acquire Signal Sciences, so the stock charts, analysis, and commentary are timely and relevant.

Business Model

Like so many high-flying growth companies, Fastly leverages the “buy revenues” business model, which reflects market participants’ 2 (a nontrivial number of entrepreneurs, management/boards, and investors) psychology that is dubbed FOMO (“Fear of Missing Out”) and is under-girded by the Fed’s POMO (“Fed’s Permanent Open Market Operations”).

We understand this is our environment, so “when in Rome….” Or, in other words, “don’t fight the FED.”

Buying Revenues

For example, It spent 33% of revenue on sales & marketing in the quarter ending June 2020 (page 11 of its 2Q 2020 shareholder letter). That’s called buying revenues, Dear Friends.

Sales and marketing expenses were $25 million in Q2 2020, representing 33% of revenue, up from $17 million, or 37% of revenue in Q2 2019. The increase was primarily driven by an increase in headcount and personnel related costs to drive future enterprise customer acquisition growth, as well as to encourage further use of our platform by existing customers.

Fastly’s 2Q 2020 shareholder letter

Nevertheless, this market environment as described does reward people and businesses that provide services related to M&A and strategic finance, including Coventry League.

Signal Sciences, a Web Applications Firewall (WAF) firm

Los Angeles area-based Signal Sciences offers web application firewall (WAF) and API (application programming interface) protection services such as firewalls and bot mitigation.

According to the Fastly’s blog announcement,

“Signal Sciences protects over 40,000 applications (including Duo Security, DataDog, Under Armour, Twilio SendGrid, and Doordash, as indicated on the company’s website), has $28 million3 As of June 30, 2020 in annual recurring revenue, and over 85% gross margin growth;…”

Fastly’s Blog

The company was founded in 2014 and has raised more than $60M of venture capital, including a $35M Series C round back in early 2019 led by Lead Edge Capital.

Financial Observations

- TTM (trailing twelve months) revenue is about $28M4 As of June, 30 2020.

- P/S (enterprise value to TTM revenue) is 27x

- Gross margins: about 85%

Fastly’s Notable Acquisitions

- April 2014: acquired CDN Sumo, an Austin, Texas-based online content delivery network for platform as a service (PaaS)-based systems

- August 2020: announced the intended acquisition of Signal Sciences

Signal Sciences Deal Structure

Regarding the latter pending acquisition, which is planned to close before year-end 2020, Fastly will use its surging stock market valuation (see above stock chart) to fund about 75% of the total transaction per the press release and a brief deal overview by Herve Blandin at The Motley Fool:

- Cash: $200M

- Stock: $575M

- Restricted stock (retention pool): $50M

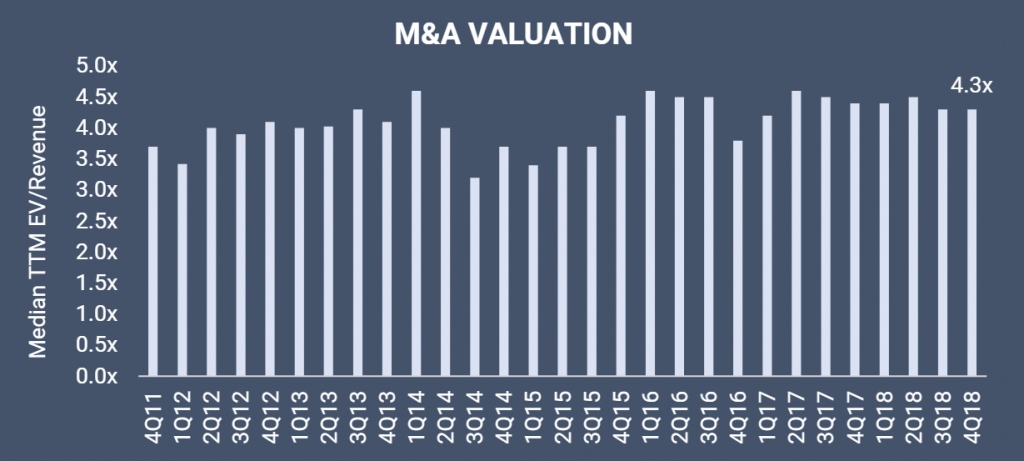

Tech EV/Revenue Valuation Multiples

To put the EV/Revenue multiples of Fastly and Signal Sciences into perspective, reference IgnitionFinancial (chart below)’s fabulous report showing historical M&A Valuation using Median TTM EV/Revenue. Likewise, cross reference these multiples with those shared in a report by MicroCap.co. They seem to align with Coventry League’s investing and M&A experience.

Wings of Icarus?

With many stock valuation multiples, including FSLY’s, flying above the clouds and even higher than young Icarus, should stock investors hedge their positions (incorporating relative long/short and multi-pairs strategies)? Coventry League would suggest, “yes.”

Q: What was Icarus’ least favorite food?

A: Hot wings.

We’d be happy to share more Icarus jokes, but they’d probably just crash and burn (okay, we’ll stop).5 These are some old, widely shared jokes.

S3 Partners’ Short Squeeze List

Remember when Ihor Dusaniwsky, an analyst at S3 Partners,6 It’s a financial data/software company. released a Top 10 Short Squeeze List back in November 2019? Guess who was number nine on that list? If you said FSLY, then you are not wrong.

- Dillard’s, Inc. (NYSE: DDS), $496.5 million short interest, 84.2% of float.

- GameStop Corp. (NYSE: GME), $273.1 million short interest, 74.7% of float.

- Health Insurance Innovations Inc (NASDAQ: HIIQ), $129.6 million short interest, 72.9% of float.

- Tanger Factory Outlet Centers Inc. (NYSE: SKT), $659.5 million short interest, 68.9% of float.

- Yeti Holdings Inc (NYSE: YETI), $510.3 million short interest, 64.8% of float.

- Pennsylvania R.E.I.T. (NYSE: PEI), $195.5 million short interest, 64.0% of float.

- Eidos Therapeutics Inc (NASDAQ: EIDX), $135.7 million short interest, 62.5% of float.

- Bed Bath & Beyond Inc. (NASDAQ: BBBY), $756.3 million short interest, 62.0% of float.

- Fastly Inc (NYSE: FSLY), $177.0 million short interest, 61.6% of float.

- Turning Point Therapeutics Inc (NASDAQ: TPTX), $92.7 million short interest, 58.1% of float.

So, it appears S3 Partners was at least partially correct in that the huge short positions in Fastly late last year contributed to the massive run-up in FSLY’s stock price in 2020 – in addition to the Covid Bump™ that we alluded to earlier in this post.

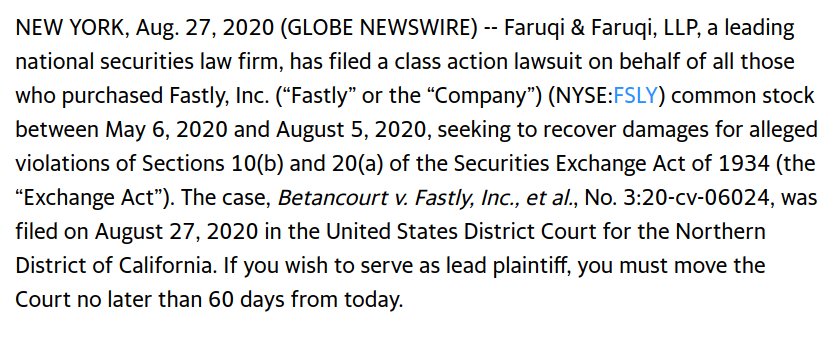

Class Action Lawsuit Secured

On the same day that Fastly announced its intention to acquire Signal Sciences, Faruqi & Faruqi, LLP, a leading national securities law firm based in New York City, filed a class action lawsuit against Fastly. It claims that the company misled investors by waiting until Q2 2020 to disclose that its biggest customer (+12% of revenue) is ByteDance, the Chinese company that operates TikTok, which has been under U.S. government pressure from 2019 related to national security issues.

Moreover, India already banned TikTok, Fastly’s biggest customer, which accounts for $1 out of every $8 generated.

Closing Words

We used to think high-flying small software companies that sold for 3x trailing twelve month (TTM) revenue got a fair shake; if they got 9x or 10x TTM revenue then that was considered a home run.

Now, according to deals like the Fastly-Signal Sciences M&A transaction, the 30x-bagger is the new 10x-bagger. Unless, perhaps, the richly-valued Fastly grossly overpaid for the $28M revenue Signal Sciences…

Comment & Subscribe

What say you?

Leave a comment below and subscribe to get alerts to our future posts and special news (the latter is only for subscribers, too!).

India bans PUBG, Baidu and more than 100 apps linked to China

https://www.bbc.com/news/technology-53998205

* Several of Tencent’s products including the hit video game PUBG Mobile and WeChat Work.

* Other apps affected include: two of search giant Baidu’s apps; CamCard’s business card scanner; Alibaba’s Alipay payment app and its Taobao e-commerce platform; Netease games including Marvel Super War; and, Sina News.