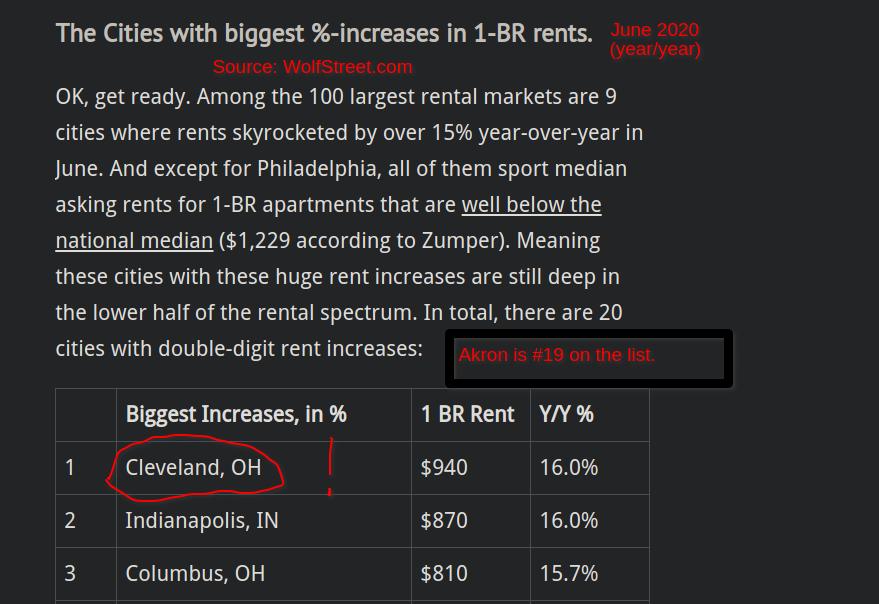

Q: What city in the United States had the most robust rental market?1 By robust, we mean biggest increase in 1-bedroom rental price.

A: Cleveland, Ohio!

The blog Wolf Street shared some compilations of data provided by Zumper.

Contents

The Cities with Biggest Percent Increase in 1-BR Rents (y/y June 2020)

- Cleveland, OH: +16.0%

- Indianapolis, IN: 16.0%

- Columbus, OH: 15.7%

The Cities with Biggest Percent Decrease in 1-BR Rents (y/y June 2020)

- San Francisco, CA: -11.8%

- Syracuse, NY: -11.3%

- Denver, CO: -10.0%

In addition to several charts and a searchable data table, Zumper also provides commentary on the Top 5 markets2 San Francisco; NYC; Boston; Oakland; San Jose. (highest 1-bedroom price) and notable changes (upward and downward) in June 2020.

For example:

Select Notable Upward Changes in June

- Lexington, KY moved up 3 spots to become the 89th most expensive city with one-bedroom rent jumping 5.6%, which was the largest monthly growth rate in the nation, to $750.3 Lexington is home to the Wildcats of the University of Kentucky.

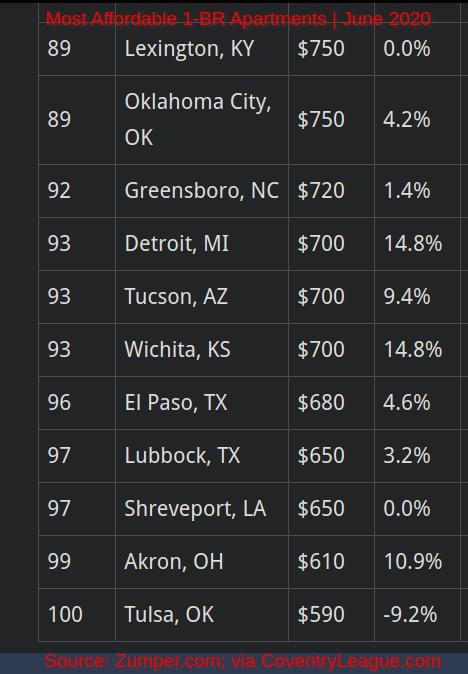

- Akron, OH jumped up 1 spot to become the 99th priciest market with one-bedroom rent growing 5.2% to $610 and two-bedrooms increasing 1.4% to $730.4 Akron is the second most affordable city of the 100 largest cities in the list.

Most Affordable 1-BR Apartments | June 2020

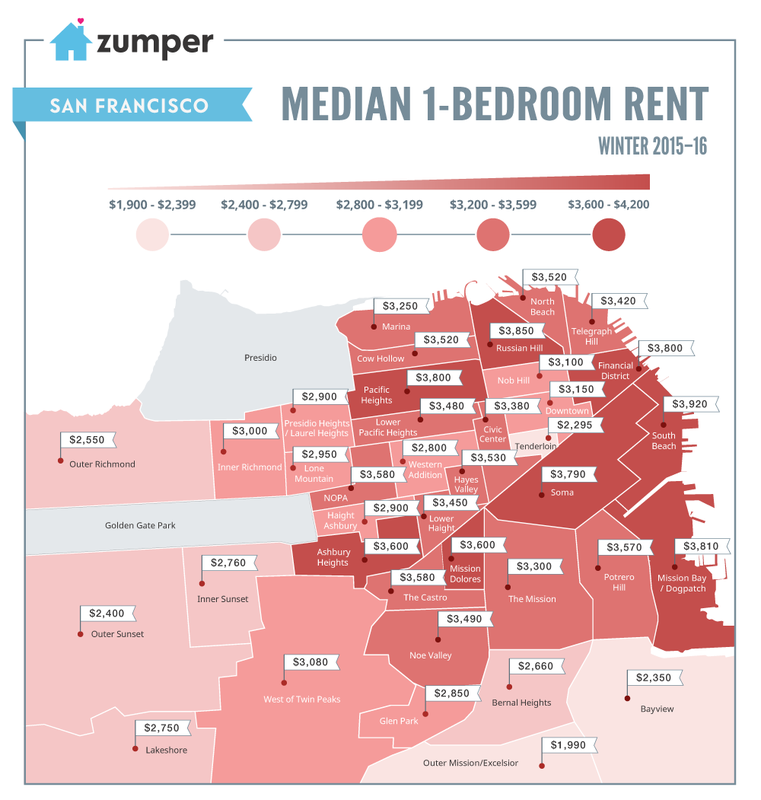

San Francisco: The Nation’s Most Expensive Rental Market

Not much has changed since Coventry League wrote about the most expensive rental market in the nation back in March 2016 except for directional change, of course.

Closing Words

Although the surge in prices in some rental markets such as Cleveland can be considered positive, there could be unintended consequences. As Wolf Richter, the author of the blog at WolfStreet, wrote:

“Markets where rents are increasing 10% or 15% a year are asking for trouble unless they have a booming job market with surging wages – this was the case in San Francisco, Seattle, and other hot markets. But if they don’t have surging wages, many renters, who are already tapped out, will run out of money. And it’s renters that keep the show going.”

Wolf Richter of WolfStreet.com, 01 July 2020