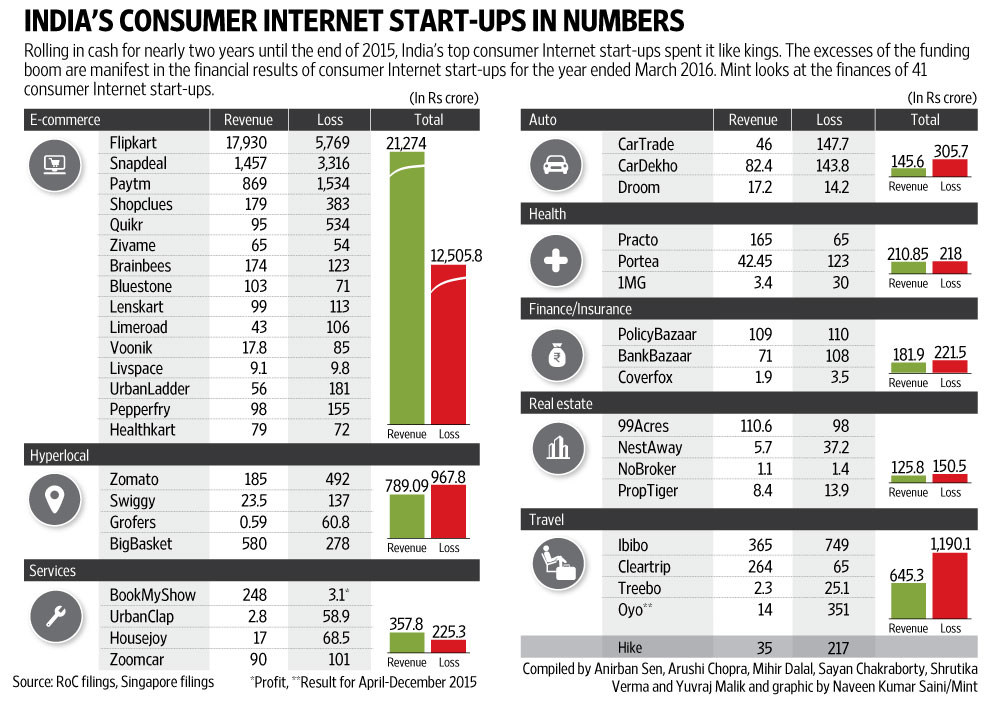

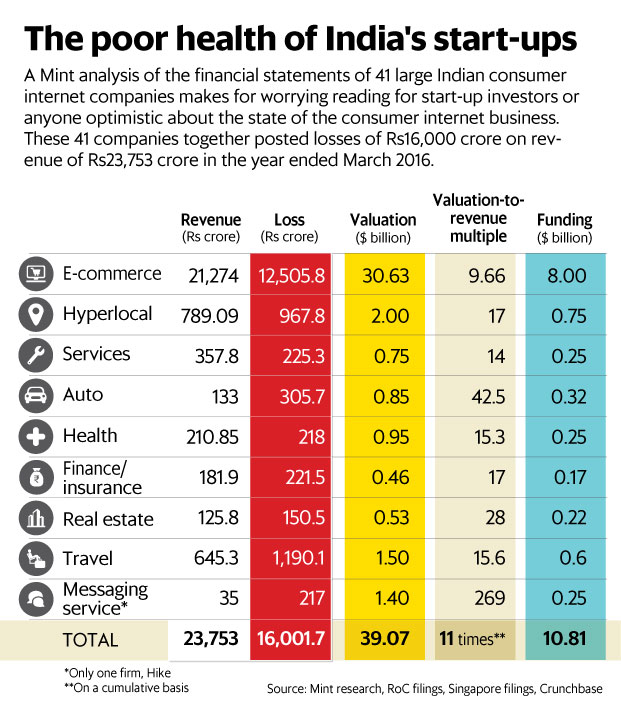

As such, these two charts below about India’s consumer internet bubble, circa 2015, reflect our perspective that valuations of many asset classes are overvalued based on fundamentals. By the way, we were introduced to the source data by a Linkedin post by Anshuman Verma, founder and managing director of M1L based in Mumbai, India.

Here’s our facetious takeaway of the two charts:

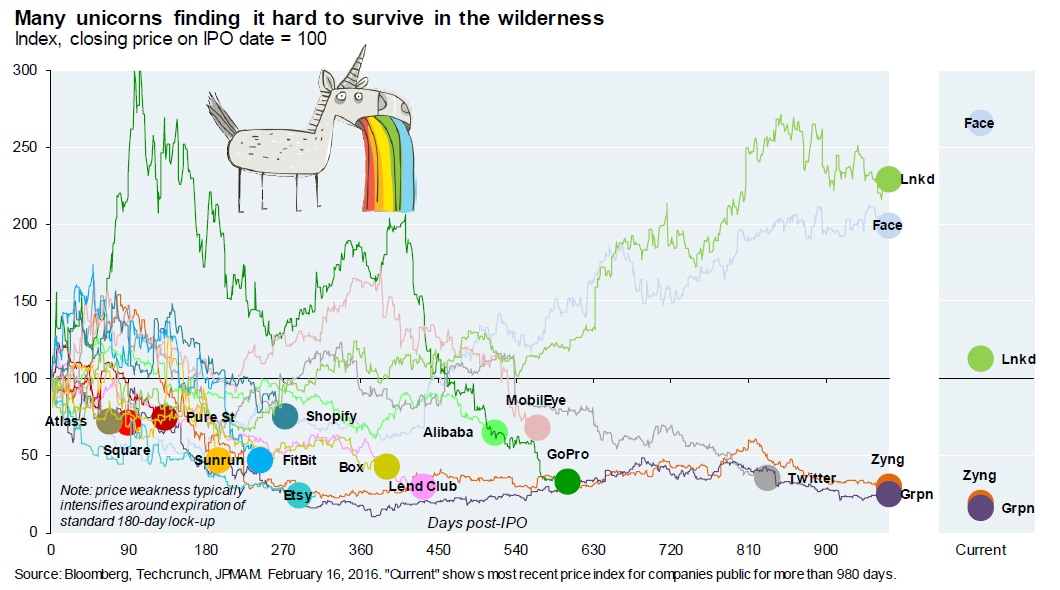

- The lack of emphasis regarding sustainable business models also permeates the culture in Silicon Valley. We’ve heard some jokingly use the term ‘venture crapitalists,’ in hushed tones, of course.

- Scale or Fail is the name of the game.

- It’s easy to buy revenues…and lose money, apparently.

“Startup tech stocks may be overvalued, but so are public equities, so are houses, so are government bonds.”

“Earlier this year, One Kings Lane, the online home goods retailer once worth almost $1 billion, sold itself to Bed Bath & Beyond, one of the companies it was supposed to displace, for just $12 million.”

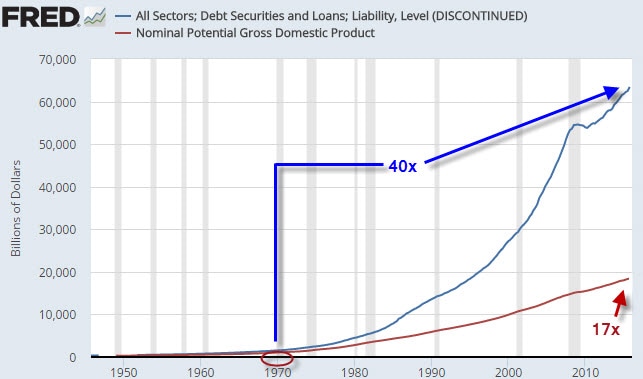

It’s our view that an underlying enabling force of many of these bubbles is centrally-controlled prices of fiat currency (central banks)—artificially low interest rates (the opposite of a free market) and expansion of the supply of currency (money creation/printing) to achieve price increases (yet, technological advances dictate lower prices). As one would expect, the survival and existence of modern day fractional reserve banks are predicated on asset price increases not decreases. So, the biggest bubbles today are really in the bond markets and in particular government bonds due to artificially low interest rates (negative real interest rates in some instances). An unintended consequence of artificially low interest rates is that investors will search for higher returns despite the inherent risks of doing so (chasing yields).

Nonetheless, what do sensible and informed people do to preserve their purchasing power and wealth? Well, David Einhorn, manager of hedge fund Greenlight Capital Management, said this about fiat currency and gold:

”The debate around currencies, cash, and cash equivalents continues. Over the last few years, we have come to doubt whether cash will serve as a good store of value. If you wrapped up all the $100 bills in circulation, it would form a cube about 74 feet per side. If you stacked the money seven feet high, you could store it in a warehouse roughly the size of a football field. The value of all that cash would be about a trillion dollars. In a hundred years, that money will have produced nothing. In a thousand years, it is likely that the cash will either be worthless or worth very little. It will not pay you interest or dividends and it won’t grow earnings, though you could burn it for heat. You’d have to pay someone to guard it. You could fondle the money. Alternatively, you could take every U.S. note in circulation, lay them end to end, and cover the entire 116 square miles of Omaha, Nebraska. Of course, if you managed to assemble all that money into your own private stash, the Federal Reserve could simply order more to be printed for the rest of us.”

TETT: Do you think that gold is currently a good investment?

GREENSPAN: Yes… Remember what we’re looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.

”Gold can be stored for a long time and, despite the price fluctuations on international markets, it doesn’t lose its value for the population as a means of savings…”

”We see that debt has shot up by a factor of 40 while income has only increased by a factor of 17. We have indeed grown our debts wildly faster than our income over the past 45 years.”