No. Dollar Shave Club’s Exit was F***ing Great.

It’s essentially the template for small, disruptive consumer products companies. It’s also pretty impressive from a growth and valuation perspective:

- Only five years old

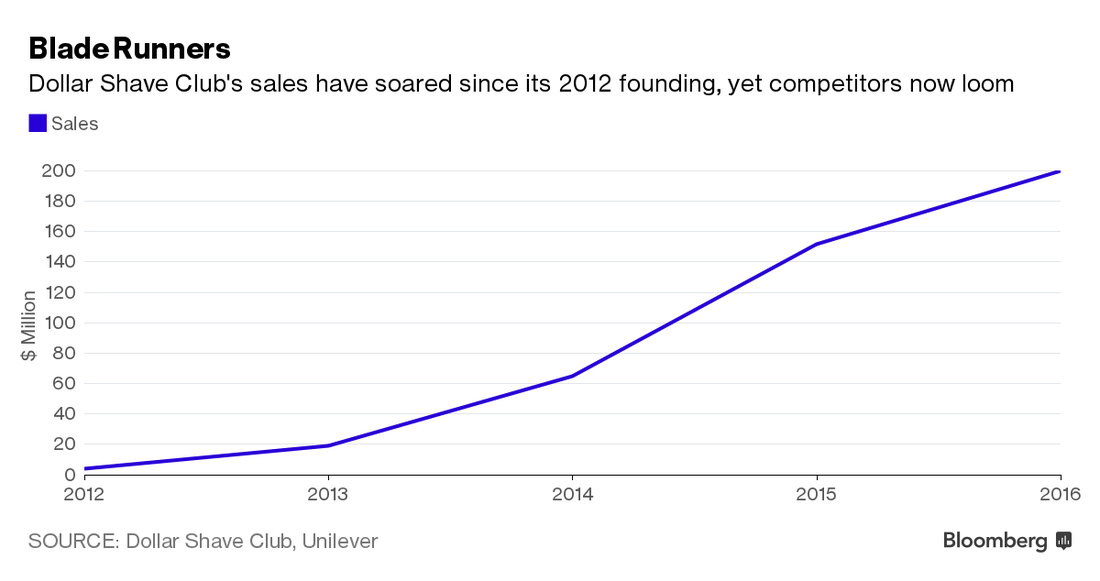

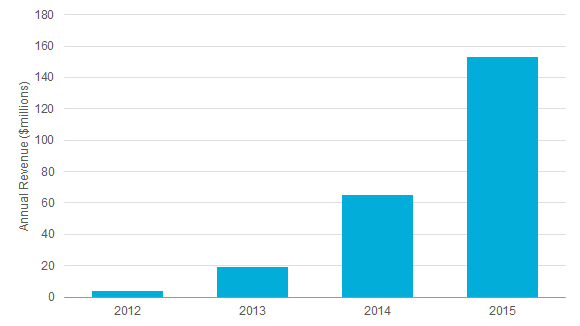

- Revenues in 2015 were $152m and are on track to exceed $200m in 2016 (>5% US market share)

- Subscriptions grew from 1,000 at year end 2011 to about 3.2m by July 2016

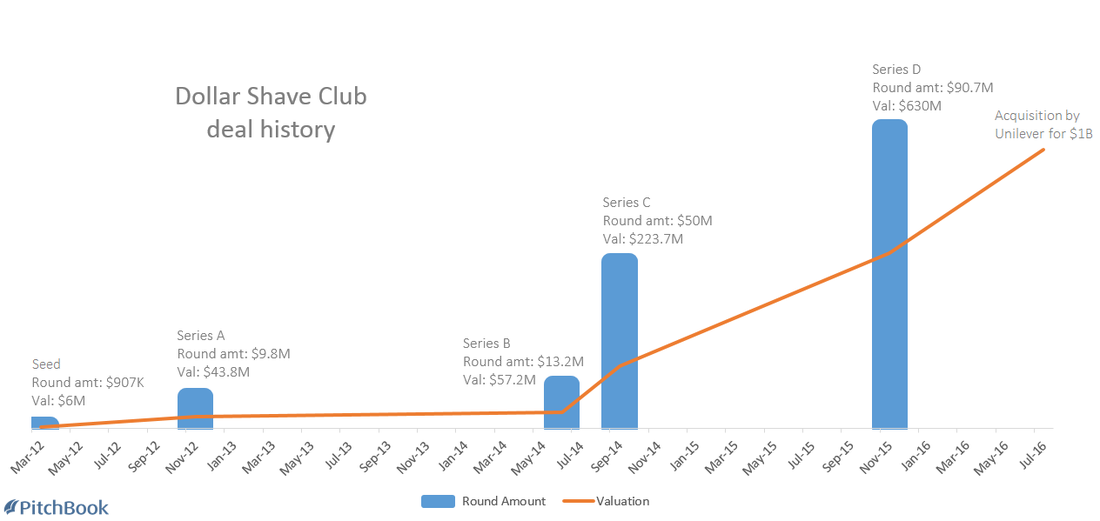

- Accepted $1B acquisition offer from Unilever (NYSE: UL) at 5x projected revenues

It should be noted, however, that Dollar Shave Club is still using the ‘nonprofit’ (buy revenues) business model and is also facing a lot of new competition (recently launched Gillette Shave Club, for example). It makes for a good case study, though.

Background

DSC employs 190 people, including 45 software engineers, and uses outsourced distribution (warehouse and fulfillment by a third-party logistics center in Kentucky where orders are packed and fulfilled automatically) and manufacturing (mostly from Dorco, a South Korean razor manufacturer with a USA division). By the way, customers may buy online directly from Dorco at a lower cost, provided customers don’t mind purchasing a ten month supply of blades. Doing so would also be better for the environment (less transportation and packaging usage, for instance), but that’s presumably not a meaningful concern to the company’s target market. But we digress.

Back on point, below are some graphs and charts curated by Coventry League Capital Partners:

Revenues

Here, however, is what’s really special and what the large consumer products companies are after: Direct-to-Consumer (DTC) online sales with predictable recurring orders and a loyal brand following. For example, the subscription market for this same category—online men’s shaving products—is estimated at $342m. This implies that DSC—and Unilever, assuming the deal closes—will have about 60% share; Gillette has about 5% of this market at the moment. Of course, competition exists and is likely to intensify from Harry’s (launched April 2013 by Warby Parker co-founder; estimated revenues in this sector of $50m; 1m subscribers; owns factory in Germany), 800Razors, Bevel, and as already mentioned, Gillette Shave Club (launched mid-2015).

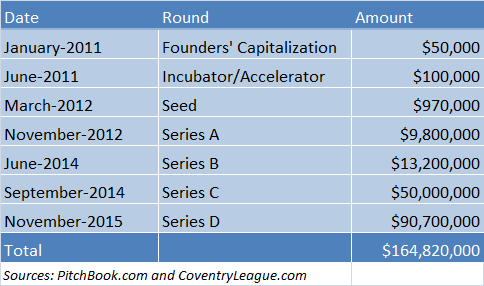

Funding

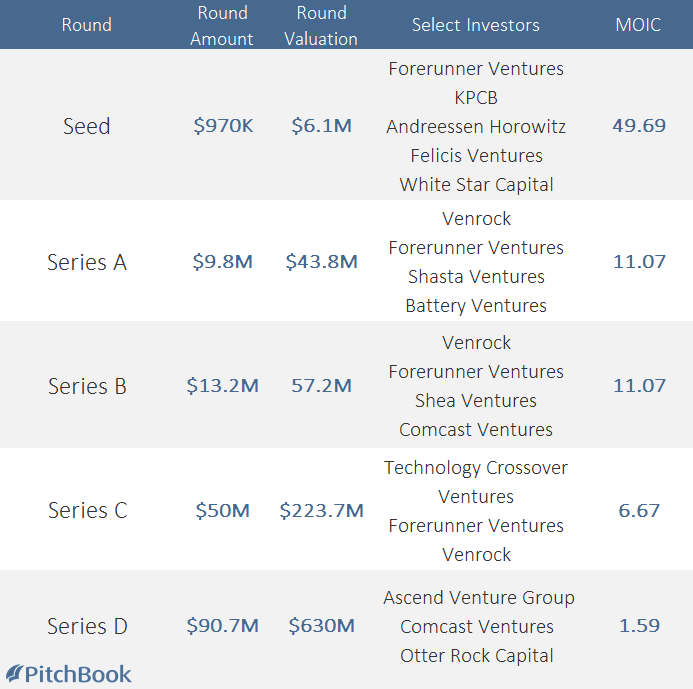

Investments continued to flow in order for the company to buy revenues and such as this business model has razor thin margins and the name of this game is scale or fail. For instance, the below table compiled by Coventry League using data from PitchBook concisely summarizes total funding.

The table by PitchBook (below) includes the main investors and a multiple-on-invested-capital (MOIC) per round. The Seed investors will get nearly 50x their investment (so, yeah, re-read the first sentence of this blog).

Hi, is there a source that shows DSC’s supplier was Dorco? Many thanks.

George

George: The primary source is Ken Hill, president of Dorco USA, who back in April 2012 publicly stated that Dorco “sells Dollar Shave Club the four- and six-blade razors that are used in its packages, but not the Dollar Shave’s two-blade option.” This implies there is or was another vendor for the two-blade razor.

Also, P&G (owns Gillette) named DSC in a Dec. 2015 patent infringement lawsuit…and P&G’s spokesperson explained why it named DSC in the lawsuit rather than presumably Dorco (which also has an equity stake in DSC).

See links below (we also updated article to include the links):

(1) Dorco as supplier of some of DSC’s razors (April 2012 by MarketWatch): https://www.marketwatch.com/story/does-dollar-shave-really-save-1334930885394

(2) Gillette sues Dollar Shave Club for patent infringement (Dec. 2015 by Recode):

https://www.recode.net/2015/12/17/11621564/gillette-sues-dollar-shave-club-for-patent-infringement

Thanks for the informative and resource rich summary on this particularly deal! Keep up the stellar work Coventry League.