Remember Mr. Einhorn? He is the manager who uncovered alleged fraud at companies such as Allied Capital and Lehman Brothers. Before everyone and their brother realized these allegations were substantiated with clear and verifiable facts, the messenger was vilified.

Given this backdrop, what are some of Einhorn’s opinions and trades of recent? First, he is expecting a major currency collapse and a surge in interest rates in the next 3-5 years (see footnote below). This is evidenced by his large allocation to gold and comments citing imprudent government deficits, among other examples.

Regarding the SEC, Einhorn is unyielding, opining in front of Congress about the SEC’s “crooked culture and lack of enforcement.” Furthermore, he does not leave doubt regarding his thoughts about too-big-to-fail companies: “break them up.” Edward Harrison, founder of the blog Credit Writedowns, summarizes these topics in an article at Seeking Alpha.

For practical investment insights, Einhorn rarely disappoints. Recently he and other investors presented Vodafone Group (UK: VOD) as being undervalued (Jan 2010).

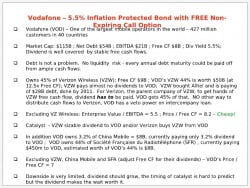

Einhorn’s thesis is based on Vodafone’s 45% stake in Verizon Wireless. Essentially, the trade is considered a “5.5% Inflation Protected Bond with Free Non-Expiring Call Options.” Market Folly summarizes the trade, including the slide below:

—————————

Note: Einhorn’s interest rate thesis does not contradict our belief presented earlier this year regarding near-term deflation.

The Euro is down to $1.25 and falling fast,,, maybe that is the currency collapse that einhorn is referring to

Security: ABACUS 2007-AC1Type: Collateralized Debt Obligation (CDO) Banker/Arranger: Goldman Sachs Hedge Fund: Paulson & Company (it helped Goldman “structure” the product, then bet against the product)Scenario: Paulson & Company informs Goldman that it believes the housing market will crash and wants to invest (short) accordingly. Long story short, Goldman creates ABACUS, and permits Paulson to help select some of the assets to be included (in this case, mortgages that are most likely to falter). Goldman then sells stakes of ABACUS to investors – pitching the investments quality. End Result: Investors lost over $1 billion; Paulson gained over $1 billion; Goldman pocketed millions in fees.

Washington Mutual (WM) Alt-A mortgage pool (aka cesspool) known as WMALT 2007-0C1. It’s highlighted on Bloomberg.Math 101:* The total pool size is $513,969,100.* $476,069,000 was rated AAA.* 92.6% of this cesspool was rated AAA.* Yet 15% of the whole pool is in foreclosure or REO after a mere 8 months* Average Fico score 705Does anyone have any reason to trust any rating from Moody’s, Fitch, and the S&P?

Columbia Journalism Review“The top six banks have assets totaling 63 percent of GDP, up from 17 percent in fifteen years”>>Separate ”too big to fail” companies into “not too big to fail entities.” >>Maintain strict guidelines on capital requirements (increase to 50% or more, versus 5% to 10%) and types of activities. >>Audit the FED,,,ideally disband it. >>Eliminate the SEC in its current form and formulate other watchdogs.>>Reform the business model of Credit Agencies“When the markets are no longer competitive, firms become a monopoly or an oligopoly and it matters more who you know than what you know.”

Einhorn was shorting Moody’s about this time last year and Buffett recently began exiting his stake in Moody’s. You’re right that they are both negative about the company. Look at some of the companies that were rated AAA or equivalent well after they got into financial troubles:American International Group (AIG) Fannie MaeFreddie MacMBIAAmbacGeneral ElectricNot to mention all the MBS and CDO Bonds***Credit rating agencies are like a doctor who diagnoses patients after they die****