When Coventry League writes about the plummeting purchasing power of the federal reserve note (aka the US dollar) because of the private, for-profit, partly foreign operative controlled1Allegedly. central bank (the FED)’s massive and ongoing printing/creation of dollars out of thin air, people eventually begin to listen and take prudent action to become their own central banks:

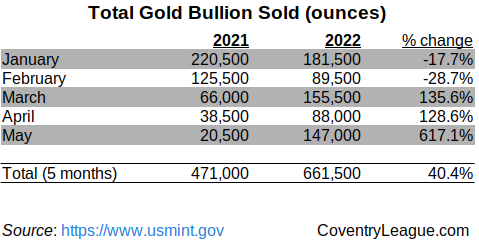

- Patriots increased their purchases of physical gold bullion (in this instance, American Eagle gold coins from the US Mint) by 40% year-over-year through May.

Contents

May 2022 Purchases Soar

What’s noticeable is people have begun nearly panic buying these coins during the month of May. Purchases in May 2022 were up an astounding 617% compared to purchases in May 2021!

Chart: YTD May Y/Y

Opinions of James Rickards

In a recent post, we quoted from one of James Rickards’ books titled Death of Money. In early May, Rickards had this to say in an interview with Greg Hunter of USAWatchdog.com:

Rickards says the minimum gold price is $15,000 per ounce in the not-so-distant future. Rickards says depending on the backing and math, it could go up in value much higher. Rickards likes silver, too, and food for the common guy. Food prices are going to go much higher according to Rickards, and in some places in the world, he expects out right starvation.

Closing Words

Now You. Have you bought any physical gold or silver coins/bars? Have you positioned into another currency such as the Ruble, which is now informally backed by oil/natural gas and gold?

Let us know in the comments.

And, as always, you are welcome to follow us on LinkedIn2Note, though, we are severely shadow-banned on that site – but it’s owned by Bill Gates’ Microsoft, so that’s not a surprise! To us, it’s actually a badge of honor. and/or subscribe to our email alerts about strategic finance and M&A. Or, just call or send us a note to discuss topics about business, finance, and acquisitions/divestitures – even though our phones are ringing off the hooks (that’s a good thing!).

[…] Businesses and people will be wise to recognize what’s happening and do the best they can to diversify one’s streams of income and physical/financial assets. […]

Peter Schiff reiterates what Coventry League stated about the Fed’s purchasing of Treasuries:

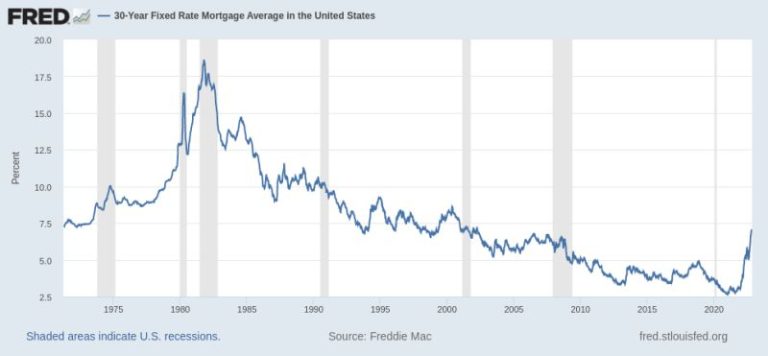

“Absent Fed buying, interest rates will have to continue to skyrocket in order to entice people to buy all of the Treasuries necessary to finance government spending. The government cannot afford to have its borrowing costs increase…

In April, the CPI was 8.3% on an annual basis. That means the Fed needs to raise rates to over 8.3% just to get the real rate to zero. And that’s using the cooked government CPI formula that understates inflation.”

From Zero Hedge’s post, “Peter Schiff: America Has Never Been In A Weaker Position To Fight Inflation.”

Test comment