By now people have awakened to the GameStop (NYSE: “GME”) saga whereby some hedge funds wrote negative research reports and opinions about GameStop and then borrowed other people’s shares of GameStop to sell in the open market (short selling) with the intention to buy back the shares after they fall precipitously.

In this post we really just want to highlight the comical, yet quite uniting, rally song (or “battle song,” if you will) that “the anons and autists” created. Secondarily, we will point to some of the problems that this GameStop saga implicitly reveals about our “fair and free market.”1 Principles, values, and “rule of law for thee, but not for me,” Peasants!

So, in this post we primarily reference the following:

- GameStop’s stock chart (year-to-date) and trading data (last ten days of trading through 29 Jan.) in a dynamic table powered by TablePress.2We referenced this free and open source project in our prior blog post.

- Lyrics to the battle song “The Tendieman” along with some external links to the audio/visual of the song and its background

- Observations about “naked shorting” and why the masses of people should take notice of this indirect, and oftentimes subtle, theft/robbery of their wealth by counterfeiting

Contents

GameStop Stock

Chart

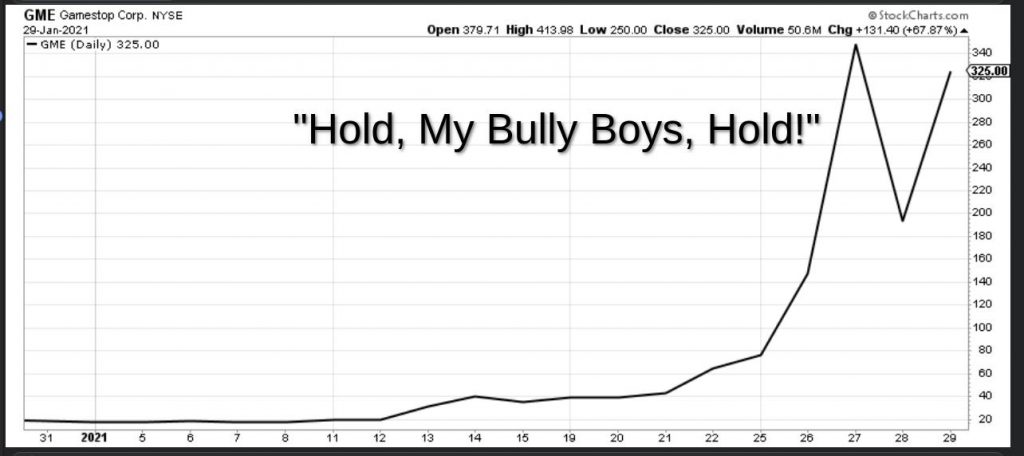

Below is a stock chart that depicts what it looks like when a few anons and autists at reddit’s r/wallstreetbets3Reddit put the channel in temporary involuntary lock-down but it appears accessible at the date of this post. unite a bunch of normies – with different political, socio-economic, religious, racial, and gender characteristics – by focusing their attention and energies on a shared disapproval of “allegedly” corrupt and morally bankrupt behavior such as naked shorting (counterfeiting racket).

Note, the above chart is through close of trading on Friday, 29 January and is based on daily close price. Over the last twelve months GME’s yearly high and low on a daily basis are $483.00 and $2.57, respectively.

Also, by the way, GME’s stock price as we publish this blog after market-close on Monday, 01 February is $225, down $100, or 30.77%. So, take note: the stock market is a casino, and the house will arbitrarily change the rules when it gets outplayed bigly.

Table

For intra-day data, reference the below table. It reveals GME’s high of $483 on Thursday 28 January and low of $34 on Monday, 15 January over a ten day trading period ending Friday, 29 January.

| Date | Close/Last | Volume | Open | High | Low |

|---|---|---|---|---|---|

| Jan 29 | $325 | 50,566,060 | $380 | $414 | $250 |

| Jan 28 | $194 | 58,815,810 | $265 | $483 | $112 |

| Jan 27 | $348 | 93,396,670 | $355 | $380 | $249 |

| Jan 26 | $148 | 178,588,000 | $89 | $150 | $80 |

| Jan 25 | $77 | 177,874,000 | $97 | $159 | $61 |

| Jan 22 | $65 | 197,157,900 | $43 | $77 | $42 |

| Jan 21 | $43 | 57,079,750 | $39 | $45 | $37 |

| Jan 20 | $39 | 33,471,790 | $37 | $41 | $36 |

| Jan 19 | $39 | 74,721,920 | $42 | $46 | $37 |

| Jan 15 | $36 | 46,866,360 | $38 | $41 | $34 |

Source: Coventry League; Nasdaq.

Tendieman Battle Song

Lyrics

The Tendieman [Verse 1] there once was a stock that put to sea the name of the stock was $gme the price blew up, the shorts dripped down hold, my bully boys, hold [Chorus] soon may the tendie man come to send our rocket into the sun one day when the trading is done we'll take our gains and go [Verse 2] she had not been two weeks from shore when ryan cohen joined the board the captain called all hands and swore, he'd take his shares and hold [Chorus] ... [Verse 3] before the news had hit the market wall street bets came up and bought it with diamond hands they knew they'd profit if they could only hold [Chorus] ... [Verse 4] no deals were cut, no shorts were squeezed the captains mind was not on greed but he belonged to the autists creed he took the risk to hold [Chorus] ... [Verse 5] for forty days, or even more the stock went up, then down once more all gains were lost it was looking poor but still those traders did hold [Chorus] ... [Verse 6] as far as i've heard, the fight's still on the shorts not squeezed and the gains not won the tendie man makes his regular call to encourage the captain, crew and all [Chorus 2x] soon may the tendie man come to send our rocket into the sun one day when the trading is done we'll take our gains and go

Audio/Visual

The apparent author of “The Tendieman” is Reddit’s u/quigonshin, who shared the lyrics and video of the song on Reddit. The song, and updated versions, has been shared on many platforms and peer-to-peer/federalist protocols so people may have access to, and improve upon, it.4Conceptually similar to the approach of free and opensource software such as Linux. YouTube channel author “Sw4y” shared the original version (19 Jan.) and several updated renditions on his channel.

Background

“The Tendieman” song is based on another song that went viral on TikTok not long ago named “The Wellerman.” It is a sea shanty song.

“What is a sea shanty?” you ask.

Well, Gavia Baker-Whitelaw of the Daily Dot wrote the following in her article titled, “We spoke to the band behind the viral TikTok sea shanty, ‘The Wellerman’:”

Sea shanties are working songs, designed to help sailors keep time while doing repetitive labor. They overlap with the call-and-response style of chain gang songs and the “waulking songs” of Scottish laundrywomen.

Gavia Baker-Whitelaw, The Daily Dot

The Daily Dot article goes on to discuss the popularity of “The Wellerman,” including a solo version sung by Scottish TikToker Nathan Evans and the original album version by the British folk band “The Longest Johns.”

We can also recommend a TikTok mash-up version posted on YouTube that incorporates several singers, including Nathan Evans, and musicians from across the globe. Quite creative, actually, and united in purpose.

Lastly, if you want to read the lyrics of “The Wellerman” by The Longest Johns, then reference the Lyrics Genius page.

Naked Shorting

Naked shorting is the selling of borrowed shares that were created from nothing, meaning the underlying company never issued these shares. It is supposed to be illegal.

Definition

Here’s a definition by Investopedia:

Naked shorting is the illegal practice of short selling shares that have not been affirmatively determined to exist. Ordinarily, traders must borrow a stock, or determine that it can be borrowed, before they sell it short. So naked shorting refers to short pressure on a stock that may be larger than the tradable shares in the market. Despite being made illegal after the 2008–09 financial crisis, naked shorting continues to happen because of loopholes in rules and discrepancies between paper and electronic trading systems.

James Chen, Investopedia

Legalized Counterfeiting

The shorts and naked shorts got cornered in a no-win position so they arranged forms of “bailouts” (financial and procedural). In effect, they changed the rules of the game and moved the goal posts so the Peasants can’t score and win the game.

In a blog post titled “Laws? Only For You. Bend Over,” author Karl Denninger at The Market Ticker provides a comprehensive explanation of shorting and naked shorting. He explains how creating a security like a stock (or any asset or currency, really) out of nothing is problematic and essentially a form of counterfeiting and theft.

But if you sell something without locating it first you are counterfeiting because you are now representing that there are 110 shares in the marketplace but the company never authorized the other 10. You thus are in fact diluting every one of the existing and real shares by 10% and pocketing the money from those sales. In short you are stealing by partially destroying the value of everyone else’s holdings in that stock.

Counterfeiting is a criminal offense — always and everywhere.

Karl Denninger, The Market Ticker

Fractional Reserve Banking

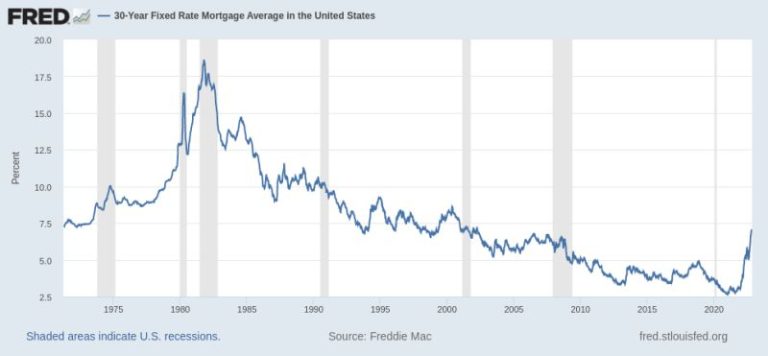

We like Karl Denninger’s explanation of dilution of value for those who own real stock shares because it is applicable to all of us. Our fractional reserve banking system essentially creates currency out of nothing (fiat currency).

The more fake currency that is created out of nothing, the greater the reduction in purchasing power (value-dilution) of existing shares of currency held by the people.

Some people like former Congressman Ron Paul have even put forth that our fractional reserve banking system along with our central bank (the Fed; it’s a private corporation partly owned by foreign investors) is unconstitutional.

We will write a separate post on this topic, but wanted to mention it because it relates so closely to the counterfeiting racket of naked shorting that benefits a few (<1%) to the detriment of the many (99%).

GameRigged

An underlying question to this story is why did GameStop have about 130% of its shares short (as reported by Karl Denninger)?5 DealBreaker stated 140%. Who were the hedge funds and other investors holding naked positions?

We aren’t sure whether Citron Research/Hedge Fund had, or has, a naked short position, but here is what it had to say about retail investors buying GME to initiate a stock squeeze against shorts/naked shorts:

The Crescendo: The tug of war came to a head late last week when Andrew Left of Citron Research was publicly discussing its short position in GameStop, claiming the company is “pretty much in terminal decline.” Left added fuel to the fire when he described buyers of GameStop stock as “suckers at this poker game.”

Those comments drew ire from what Left described as an “angry mob” of Reddit retail traders who were, he says, acting in a coordinated fashion to push the stock higher:

DealBreaker (blog post)

The above quote is from an article published last week by DealBreaker titled “GameStop Short Sellers Are Getting Slaughtered.”

Nevertheless, it’s quite easy to identify stocks that are heavily shorted or have naked short positions. What is also becoming easier to do is unite with a lot of other like-minded investors and people to execute a counter-bet against the shorts and naked shorts, especially when the shorts say things like Citron Research.

This latter point also partially explains why so many tech firms, brokerages, losing hedge funds, and their acolytes have restricted retail investors from timely communicating on social media forums/channels and freezing trading at certain brokerages.

Closing Words

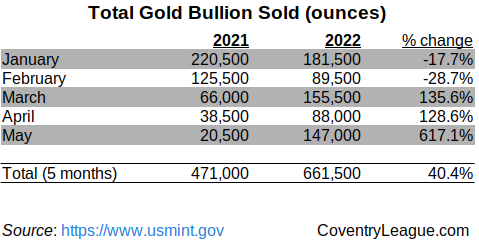

Now you. Do you like the sea shanty songs? Do you think we will see meaningful change related to naked shorting and fractional reserve banking in order to return these activities back to sound shorting strategies (backed by real shares) and sound coinage of money (100% backed be gold and silver)?

Let us know on our LinkedIn page, subscribe to our blog alerts, or leave a comment below (note: submissions are delayed for a day or so to screen-out the robots).

Mish at the street also wrote about the fraud of naked shorts.

Naked Shorting is Illegal: So How the Hell was GameStop 140% Short?

https://www.sgtreport.com/2021/02/naked-shorting-is-illegal-so-how-the-hell-was-gamestop-140-short/

Rule #1 The Casino Always Wins