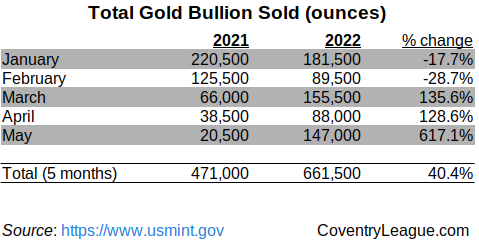

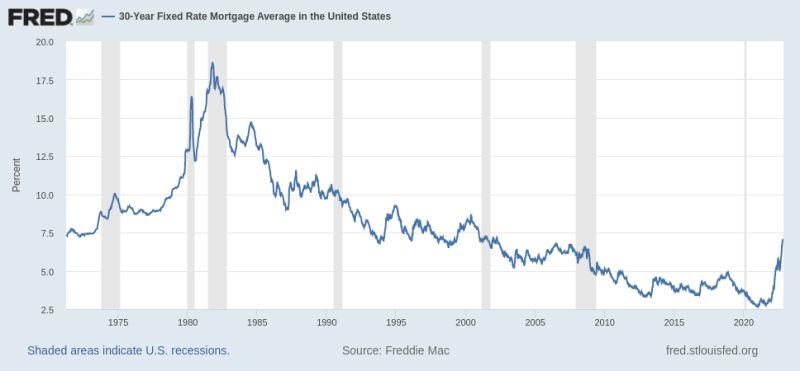

Considering the more than doubling of the average 30-year fixed mortgage rate in the past 12 months, it is not unreasonable to expect a 40% plummet in house prices in real terms in the near future (let’s say 18-24 months).

The current fixed rate of a typical 30-year mortgage is about 7.00%. At the same time last year the fixed rate was roughly 3.00%.

Our mental rule-of-thumb tells us that the price of the same house, in our debt-based society, should drop by roughly 40%, all else being equal (or, ceteris paribus, to use the parlance of some Harvard econ majors).1 Our Fearless Leader, Joe, posted this theme initially on the “allegedly” shadow-banning Linkedin, a walled-garden social media platform.

Of course, there’s friction and whatnot in the housing markets, so house prices don’t behave exactly like that of Treasury bonds to changes in interest rates.

Nevertheless, mark our post, if fixed mortgage rates hold at ~7% – or increase further to double-digit land, which wouldn’t surprise us – then expect the typical house price, in real terms, to fall precipitously (that is, after adjusting for the loss of any purchasing power of your favorite fiat currency).

A Basic Example

Back of the envelope calculations:

- $100,000, 30 years, 3% = ~$400 payment

- $ 60,000, 30 years, 7% = ~$400 payment

If you want to fact check us (and we encourage you to do so!), then here is one of many online financial calculators. Alternatively, if you have one of those venerable HP-12C financial calculators – the models with the awesome Reverse Polish Notation (RPN) – then dust it off.

Do note, in our simple example, if one’s purchasing power is cut in half, then what once was a $100,000 house price is now a $200,000 house price in nominal terms (in real terms it’s still $100,000). Likewise, if the purchasing power of one’s currency is cut in half, but the house price increases to only $120,000, then one experiences a 20% nominal increase, but a 40% plummet in real terms. Many people don’t realize this. In a way, it’s a quasi shell game deployed under a centrally controlled, fiat/debt-based monetary system). Hence, our “all else being equal” qualification.