Last Thursday our beloved central bank, the FED, released its new “hypothetical scenarios” for its annual stress test of the largest U.S. banks (assets > $100 billion).

Contents

Key Criteria

This year 34 banks will be tested on criteria to include enduring the following scenarios:

- A 6% surge in the unemployment rate, from 4% to 10% (or from 24.5% to 30.5% based on accurate data used by ShadowStats)

- A 40% collapse in asset prices (equities/stocks, residential and commercial real estate, etc.)

List Formation

Based on our back-of-the-envelope calculations, here is a list1Tongue in cheek, to a small degree. of the largest U.S. banks that could survive the upcoming hypothetical scenarios (without further assistance or taxpayer asset confiscations, of course):

List of Banks that Could Survive Stress Test

| Large Banks (Sep. 2022) | Survive Test? (Yes/No) |

|---|---|

| Ally Financial Inc. | No |

| American Express Company | No |

| Bank of America Corporation | No |

| The Bank of New York Mellon Corporation | No |

| Barclays US LLC | No |

| BMO Financial Corp. | No |

| BNP Paribas USA, Inc. | No |

| Capital One Financial Corporation | No |

| The Charles Schwab Corporation | No |

| Citigroup Inc. | No |

| Citizens Financial Group, Inc. | No |

| Credit Suisse Holdings (USA), Inc. | No |

| DB USA Corporation | No |

| Discover Financial Services | No |

| Fifth Third Bancorp | No |

| The Goldman Sachs Group, Inc. | No |

| HSBC North America Holdings Inc. | No |

| Huntington Bancshares Incorporated | No |

| JPMorgan Chase & Co. | No |

| KeyCorp | No |

| M&T Bank Corporation | No |

| Morgan Stanley | No |

| MUFG Americas Holdings Corporation | No |

| Northern Trust Corporation | No |

| The PNC Financial Services Group, Inc. | No |

| RBC US Group Holdings LLC | No |

| Regions Financial Corporation | No |

| Santander Holdings USA, Inc. | No |

| State Street Corporation | No |

| TD Group US Holdings LLC | No |

| Truist Financial Corporation | No |

| UBS Americas Holding LLC | No |

| U.S. Bancorp | No |

| Wells Fargo & Company | No |

Key Takeaways

Businesses – all types and sizes – and individuals can take additional precautions to safeguard their liquidity and storage of wealth by diversifying away from banking institutions that are less sound than others. Even though some deposits are insured, financial institutions could still affect liquidity in the short term by implementing emergency actions such as temporarily freezing accounts, limiting the number and dollar amount of transactions, calling revolvers, and even confiscating assets (extreme situation).

One example of the latter occurred about nine years ago (March 2013) in Cyprus when its people got up one Saturday morning to learn that their bank accounts – business and individual – were effectively frozen. Essentially, certain depositors had their funds converted into bank equity. This occurred after an attempt to tax the deposits (confiscate them) was rejected.2“The Death of Money” by James Rickard, 2014, ch. 9 (Gold Redux), pgs. 218-219. A detailed infographic of the Cyprus Financial Crisis: Depositor Confiscation is provided by Demonocracy.

And, if you think it can’t happen in Europe or the United States, then read the blog from March 2013 by author Ellen Brown titled, “It Can Happen Here: The Confiscation Scheme Planned for US and UK Depositors.”

Although few depositors realize it, legally the bank owns the depositor’s funds as soon as they are put in the bank. Our money becomes the bank’s, and we become unsecured creditors holding IOUs or promises to pay. (See here and here.) But until now the bank has been obligated to pay the money back on demand in the form of cash. Under the FDIC-BOE plan, our IOUs will be converted into “bank equity.” The bank will get the money and we will get stock in the bank. With any luck we may be able to sell the stock to someone else, but when and at what price? Most people keep a deposit account so they can have ready cash to pay the bills.

“It Can Happen Here: The Confiscation Scheme Planned for US and UK Depositors” by Ellen Brown, March 2013

Helpful Tips

First, duly acknowledge what J. P. Morgan said back in 1912 prior to the formation of the FED, our central bank.”3Money is gold, and nothing else.” J. P. Morgan’s Testimony. Dec. 18-19, 1912. Coincidentally, Mr. Morgan died shortly thereafter (31 March 1913).

Money is gold, and nothing else.

J. P. Morgan’s Testimony. 1912.

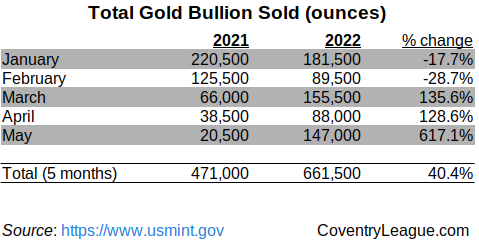

- Physical gold and silver in your control and possession as a storage of excess wealth

- Barter trade arrangements with key vendors or neighbors. Local papers and craigslist have barter trade ads. Also, note, General Electric has (or had) a barter trade desk.

…barter is a rapidly growing form of economic exchange today, because networked computers solve the simultaneity problem. One recent example involved the China Railway Corporation, General Electric, and Tyson Foods…. GE, which has an eighteen-person e-barter trading desk, quickly ascertained that Tyson Foods China would take delivery of the turkeys for cash. China Railway delivered the turkeys to Tyson Foods, which paid cash to GE, and then GE delivered the locomotives to China Railway. The transaction between GE and China Railway was effectively the barter of turkeys for turbines, with no money changing hands.

“Death of Money” by James Rickards. Ch. 10 (Crossroads), pg. 255

- High quality notes or bonds denominated in a different fiat currency or backed by quality, liquid hard assets. Even the U.S. issued bonds denominated in Deutschemarks and Swiss francs. These were dubbed “Carter Bonds.” They were issued initially in 1978 when inflation was soaring and confidence in the dollar’s purchasing power was plummeting. The buyers of these bonds did well; the buyers of bonds denominated in the local currency, not so much.

- Trade-able assets aligned to your local community. For example, coffee, whiskey, cigarettes, lumber and land (can lease it to farmers, wind-mill operators, natural gas operations, etc.), hunting implements and ammunition, among other tips that Coventry League mentioned in the past here, here, and here.

Closing Words

Now you. What banks (local, regional, and big/global) do you think are well positioned to survive the “hypothetical scenarios” of the FED’s stress test? What precautionary measures do you believe businesses and individuals should take to protect their liquidity and wealth? Let us know in the comments or on our LinkedIn page.

Also, reach out to us if you have questions about mergers, acquisitions, and divestitures (we just refer to that as M&A) and strategic finance, whether or not you’re just contemplating a strategic initiative in the near future or are just curious about your options some time down the road.

Our fees are reasonable; our performance is top-notch.

[…] also use a lot of scuttlebutt, too. Doing so helps explain why so many of our clients gain a massive competitive advantage by leveraging our opinion about opportunities and risks across various industry […]

Canada is already implementing bank account deposit freezes and seizures on people and businesses that are peacefully protesting in the trucker convoy.

Toronto-Dominion Bank (TD Bank) just seized two bank accounts, about 1.1 million USD, that were used as donation accounts for the truckers. TD Bank, the US domiciled one, is on your list of banks that likely can’t survive the stress test.

How long until governments demand that banks seize deposits of individuals and businesses that go against vax shots and totalitarian mandates?

Thank you for your post, a friendly reminder to all about counterparty risk.