If one is in the market for a loan, then pricing based off of the 10-year US Treasury Note yield might be attractive. Any non-systemically-important business needs to have back-up plans, which include alternatives to bank lines-of-credit and term loans. For instance, during the 2008-2010 financial crisis, Coventry League was inundated with calls from CEOs and presidents, business owners, and CFOs asking for our strategic finance services to help them procure replacements to their lines-of-credit and expiring term loans, since their respective “relationship” banks were simply pulling credit with a 30-day notice. We obliged and delivered – even though we had warned of a pending downturn back in 2006 and 2007 when the proverbial punch bowl was still on the table at the party. Few listened – and paid the price for their errors of omission.

Contents

When To Refinance Loans and Restructure Debt

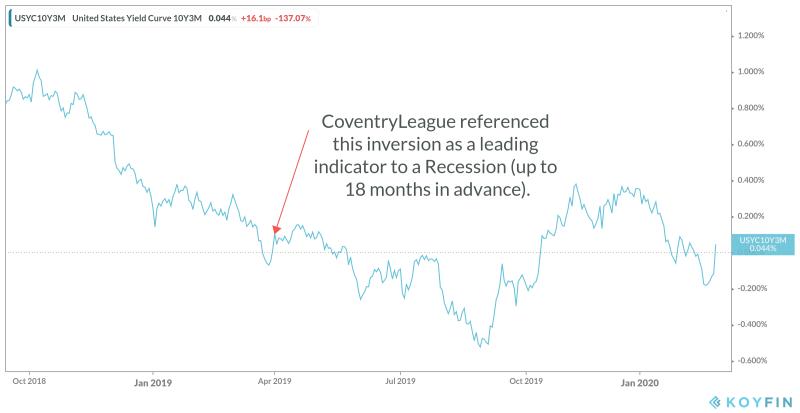

How soon is now? Coventry League warned and predicted back in spring 2019 that it was likely that a form of quantitative easing (QE4) and zero interest rate policy (ZIRP) would be implemented later in 2019 with an economic recession being formally recognized within 18 months.

Well, we have already had variations of QE programs and backdoor bailouts for the chosen – just consider the massive “temporary” repurchase agreement programs that were devised in July 2019 and initiated in September 2019 to effectively bail-out systemically important global financial institutions and market participants (big hedge funds), directly and indirectly. However, an economic recession hasn’t been formally pronounced – yet. Therefore, we highly encourage prudent and reasonable owners and executives to take action very soon with respect to their strategic finance to refinance loans and restructure debt.1 One can read more about why one needs an electrical backup plan (“redundancy”) in our blog post about the Fraying Grid.

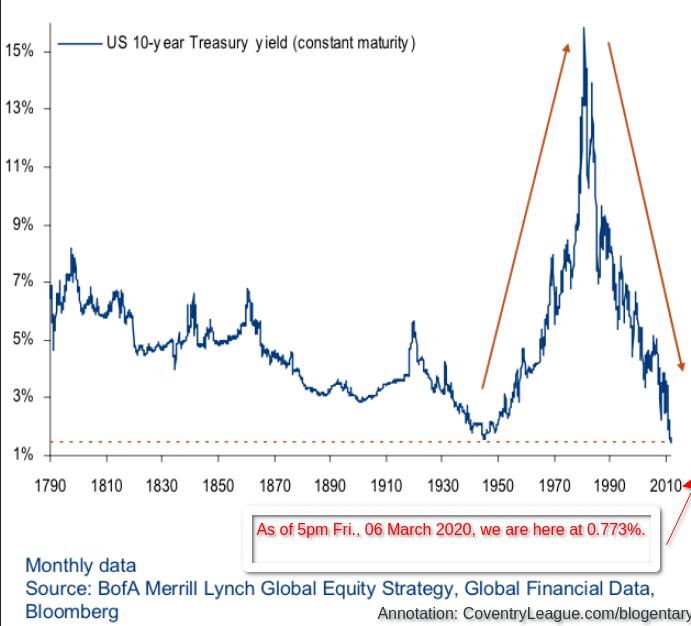

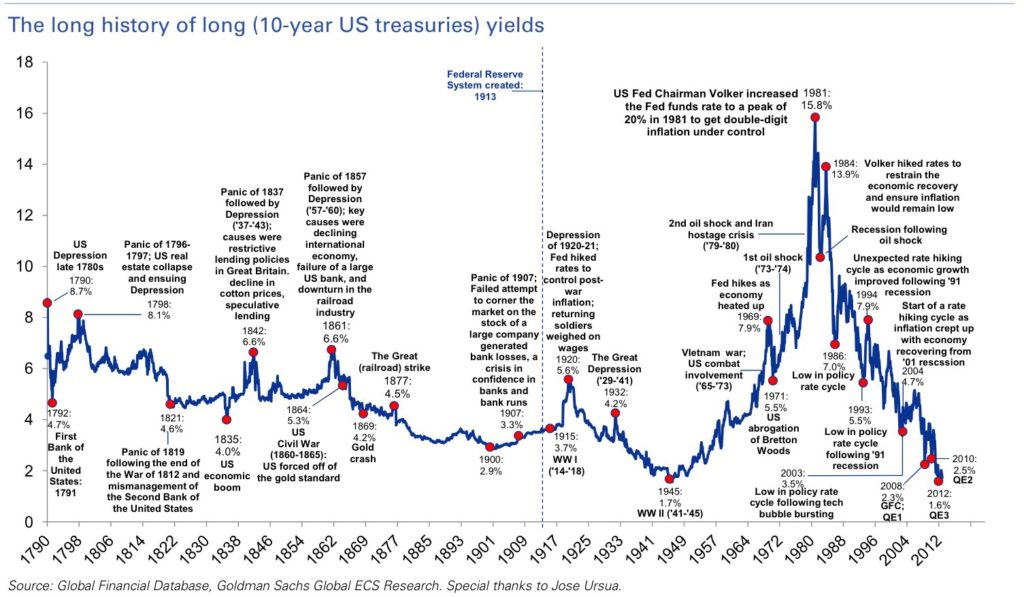

10-Year US Treasury Note Yield Lowest In 230 Years

Anyway, let us revisit interest rates more holistically going back to 1790 to see the detrimental effects created by a central control-and-command market for money (interest rates are the price of money). From 1790 until 1913 when Congress enabled the privately-controlled federal reserve bank (FED), the range of the 10-year treasury yield was between about 3.0% and 8.0% (just under a 5% range). Now look at what the FED has accomplished. From 1913 until present, the range is from under 1.0% (0.773% as of yesterday, 06 March 2020) to over 15.0%, a range of over 14%. That’s nearly 3x the magnitude that occurred during the 120-year period in which our nation had a relatively free market for the price of money (i.e., no privately controlled central bank). Moreover, this negative impact is more noticeable after 1971 when President Nixon removed the US dollar completely off of the gold standard.

The below chart (click to enlarge), which may also be found at aei.org, “shows the history of 10-year US Treasury yields from 1790 to 2012 (via Goldman Sachs). Note that interest rates in the US were more stable before the creation of the Federal Reserve than after it was created in 1913.”

Every major [economic] contraction in this country has been either produced by monetary disorder or greatly exacerbated by monetary disorder. Every major inflation episode has been produced by monetary expansion.

Milton Friedman, writing about Monetary Policy (c. 1968)

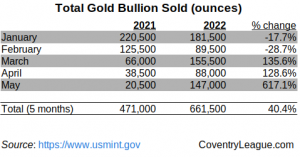

Meanwhile, Look at Gold

Why do We the People tolerate this? After all, many wise men from time immemorial such as Thomas Jefferson, Ron Paul, and Jesus have suggested to “remove the money-changers from the temple.”

Closing Words

So, do you have your strategic finance house in order? Are you vulnerable to having your line of credit and term loan reduced or even pulled by your “relationship” bank, which will sometimes only provide a 30-day notice for you to find a replacement capital provider to refinance loans or restructure debt?

When liquidity tightens and SHTF (pardon our acronym) like it did during the 2008-2010 period, Coventry League highly encourages one to have a back-up strategic finance plan already in place. If you haven’t done so already, then we suggest your doing so sooner than later – and we are already past the “sooner” point in the curve.

As such, it is best to contact us about our strategic finance and M&A services before the line of owners, CFOs, and CEOs outside of our doors wraps around the block, which will happen once liquidity tightens. The latter generally occurs slowly, then all at once.

Nevertheless, for those who might want to procrastinate, then no worries: we also provide turnaround/restructuring, Distressed M&A, and pre-bankruptcy support.

Update (pre-market, 6:30am ET, Monday 09March):

* It’s Panic and risk off across the board.

* Entire Yield Curve has collapsed below 1% (even the 30-year bond).

* S&P 500 Futures market was halted Sunday evening (limit down–meaning investors/algos aren’t permitted to sell).

https://zh-prod-1cc738ca-7d3b-4a72-b792-20bd8d8fa069.storage.googleapis.com/s3fs-public/styles/inline_image_desktop/public/inline-images/TSY%20curve%203.9.jpg?itok=QDy_vCnH