It’s easy to beat “sophisticated” investors

- Amazon.com is experiencing shrinking margins, increased R&D expenses, and decreased efficiency. Can anyone say Layoffs and Stock Price Haircut?

- Remember Whitney Tilson? He went short Netflix when the stock exploded higher. Now, Tilson explains why he went long Netflix as it continues to behave like a falling knife. He insists he “Hasn’t Lost His Mind.”

- Again, most (let’s say 98%) of professional investors such as mutual, hedge, venture, private equity, and institutional (pension, endowment, etc.) fund managers are effectively incompetent. They prefer the euphemism of “having a bout of negative alpha,” by the way. Monkeys need to be given more consideration, apparently.

- Jon Stewart’s extended interview with the GOP candidate who is often ignored by mass media. You know, Ron Paul, the guy with a credible plan.

- Are Californians or New Yorkers happier? That’s just one of the questions cognitive psychologist Kahneman addresses in his new book, “Thinking, Fast and Slow.”

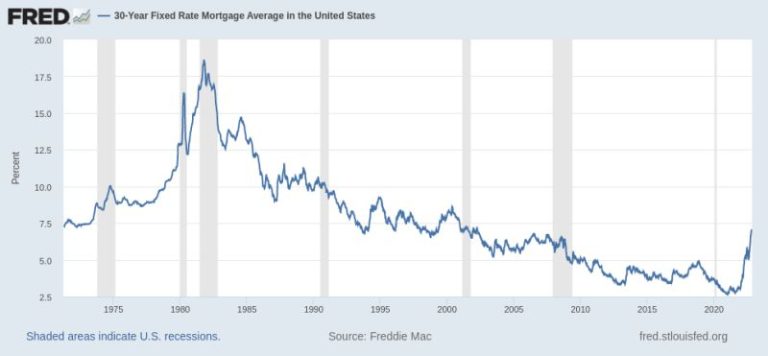

- It makes one curious why the Occupy Wall Street movement doesn’t have a laser focus on two institutions: the FED and the Congress. The snickering from abroad you hear are from the youth of Cairo, Tehran, Athens, and other places. Here’s one former hedge fund manager’s perspective on the movement (in San Francisco).

- Piggybacking on the trades of activist investors is not without peril. According to AlphaClone, here are the average annual returns one would have generated by cloning the portfolios of a few better known managers such as Barry Rosenstein’s Jana Partners (13.5%), Daniel Loeb’s Third Point (8.9%), and Bill Ackman’s Pershing Square (4.3%). Not impressive.