Adding a talented full-time CFO to manage a small or medium-sized company’s high-finances such as acquisitions and divestitures (M&A), banking and investor relationships (debt and equity), capital structure and cash flow/EBITDA optimization, transaction positioning and preparation, actionable insights, and financial policy (including oversight of a controller, bookkeeper, or department) is not cheap.

Contents

Average CFO Salaries

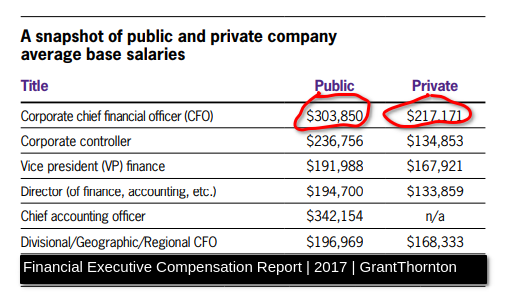

Back in 2017, Grant Thornton, a global accounting and financial advisory firm, released a compensation survey titled “Financial Executive Compensation Report 2017.” It found that the average base salary for a CFO at a public company was $303,850 and at a private company was $217,171.

Since these figures are averages, they are likely skewed a bit higher than the median amount, particularly with respect to public companies. Note, base salary is just one component of the cost/price of a CFO. Other costs include payroll taxes, fringe benefits, bonuses (sign-on and retention), variable compensation, insurance, and so forth. Therefore, if one wants to perform a back-of-the-envelope comparison calculation, then one would have to at least double the base salary to get a comparable figure to, say, a contractor or service provider. The report, however, does include some of these other costs separately.

The Average Private Company CFO Salary in 2020

To get more granular, Driven Insights – which performs mostly outsourced bookkeeping and accounting services – wrote about the average CFO salary for smaller private companies and the amount was not much lower than what Grant Thornton provided:

According to CFO.com, the average cash compensation for a CFO in a private company with less than $20MM in annual revenue is $194,354. CFOs for private companies with $21-$99MM in annual revenue make an average of $237,983 in base salary. (Private company CFOs make 45% less than those at public companies.) Tack on benefits and bonus and you can expect to pay $225,000 to $275,000 depending on business size.

Driven Insights, Feb. 2020

Controller or CFO?

Now, let’s be clear: the important duties of a bookkeeper, accounting manager, and controller are not necessarily interchangeable with the duties of a strategic CFO, as Janine Popick, CEO and co-founder of VerticalResponse can attest. The latter is where big picture strategic insights and analysis, competitive advantages, and proper policies are best formulated. It is where a finance guru seems to “think different,” to reference Steve Jobs’ statement.1 Remember Apple’s “Think Different” logo? Likewise, a quality CFO or Investment Banking Kiosk should be able to understand business models and value drivers, distill and communicate these concepts, and devise and oversee implementation of improvements (including financial/accounting policy and scalable systems).

How to Assess Contract CFO Talent

It is estimated that for every thousand CPAs/controllers/accounting managers/bookkeepers in the labor market there is only one top-tier strategic finance professional. So, how do you identify the potential top-tier contract CFO or advisor at an investment banking kiosk?2 It could range between 1:100 and 1:10,000 depending on one’s subjective and objective definitions of talent and criteria.

“Mediocrity knows nothing higher than itself; but talent instantly recognizes genius.”

Arthur Conan Doyle, The Valley of Fear

3 Attributes of Top-Tier Contract CFO Talent

- Has prior staff and management experience at operating companies, especially in multiple functions and industries

- Has investment banking experience from a Top 20 global investment bank coupled with regional/boutique investment banking experience and all based in a financial center such as New York City, San Francisco, or London. Again, it is best if that person has worked in different groups, particularly debt capital markets, structured finance, leveraged finance, and M&A – and in positions such as senior associate and vice president. These particular professionals are at the intersection of execution and business development – and are often considered the “starting quarterback” of a transaction.

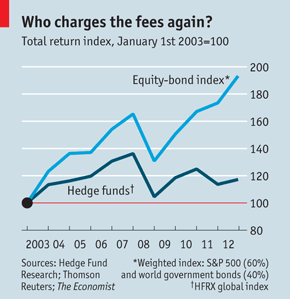

- Has direct investing experience at a smaller firm that is performance-oriented. Minimally-staffed lower middle market private equity firms and smaller hedge funds are good indicators. Bonus points for outperforming competitors and indices over at least one business cycle.

Cream of the Crop Differentiation

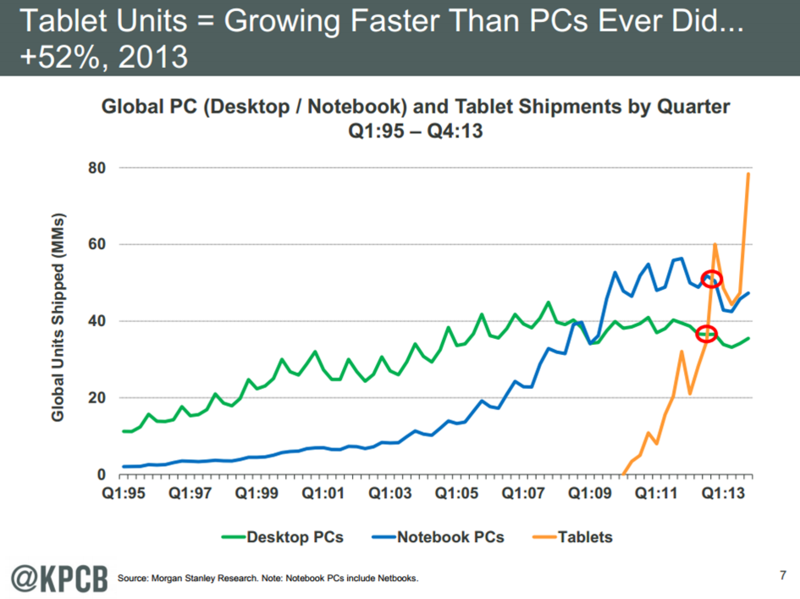

One alternative objective measurement to assess the latent talent of a potential contract CFO (or CEO for that matter) is to determine whether that individual is a good investor. This prowess is a direct relation to one’s ability to refine business models, assess competitors, and implement winning strategies and tactics. It is also one of the rarest talents in the marketplace. For example, less than 1% of professional investors can perform better than a common index over a 10 year period.

How To Compete Like a Champion

So, how do some savvy Silicon Valley emerging growth companies leverage this strategic finance talent affordably? Answer: Investment Banking Kiosks and remote Contract CFOs.3 In the recent past, leading up to 2020, the term seems to have changed to “Fractional CFO.”

4 Questions to Ask

Accordingly, here are the Top 4 Questions for owners/operators, boards of directors, and CEOs to ask to decide whether their organization can create value by using a remote Contract CFO or Investment Banking Kiosk:

- Do you lack detailed financial data that’s critical to making sound business decisions?

- Is someone closely watching your costs?

- Are bankers, suppliers, shareholders, merger & acquisition partners, and even customers frustrated by the absence of CFO talent?

- Is your company growing faster than its financial system can manage?

Cost Savings of Contract CFOs and Investment Banking Kiosks

We will again reference data from Driven Insights regarding the typical market rates for average Contract CFOs. Often, if you procure a more performance-oriented, top-tier professional or investment banking kiosk, then they will not necessarily charge a higher fixed cost but rather incorporate a performance incentive (like an athlete winning games, scoring touchdowns, etc.).

Most providers will create a custom quote based on your specific needs. The spend can range from $1,200 – $2,500 per day.

Driven Insights: Cost of a Contract CFO in 2020.

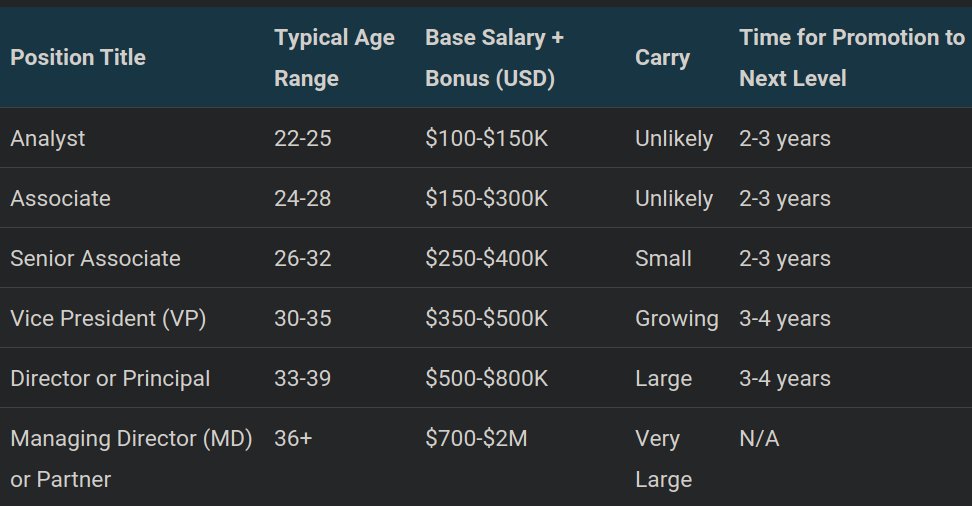

Private Equity Compensation

So, if you are fortunate to convince a Cream of the Crop professional or investment banking kiosk to support and add objective value to your team, then you will likely save a lot more money, relatively speaking, with respect to fixed costs given the typical mid-point of annual base and bonus compensation (not including other benefits and payroll tax) of experienced private equity professionals4 Investment banking professionals have similar cash compensation; more senior private equity professionals are awarded equity, too. is about $500,000 according to the website, “Mergers & Inquisitions.”5 For managing directors, the total of base and bonus typically exceeds $1 million. We believe bench-marking private equity compensation is appropriate since the responsibilities of these professionals include high finance and operating company oversight.

Closing Words

All this said, Coventry League would gladly provide feedback, strategies, and pricing arrangements regarding the use of contract CFOs, investment banks, investment banking kiosks, and other business related initiatives. Of course, we can provide referrals or guidance to other firms and talent–since we may not necessarily be the best match for each and every potential client and we have a pretty good network.

Contact Us

So, get in touch by using the contact form or sending our office or one of our principals a direct email to arrange a telephone call or meeting over a cup of coffee.

In the meantime, try to Compete Like a Champion.6 This is a spin on the Notre Dame football motto (which is also the tagline of a nonprofit in South Bend, Indiana).

Note: We originally published a version of this post on 2014-06-20.