Back in January of 2020 we wrote that the number of WARN Notices about mass layoffs in Ohio had already surged by about 50% in 2019 versus 2018, despite mainstream media (MSM), politicians, and many people’s suggesting that the economy and labor market were better than ever. We also stated that we would provide an update regarding mass layoffs in Ohio by sharing WARN Notices for 1Q 2020. So, here we are with facts and data in hand.

Contents

Introduction

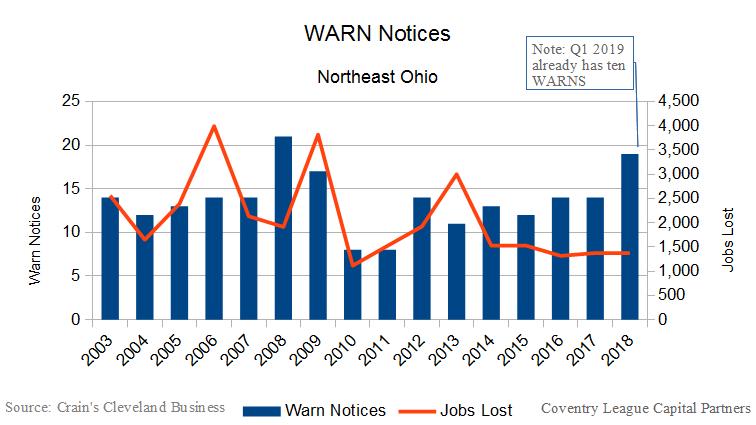

First, as a brief refresher, WARN Notices relate to mass layoffs. The acronym refers to the federal Worker Adjustment and Retraining Notification–WARN–Act, which has required companies that have 100 or more full-time workers at one location to notify a state jobs agency 60 days in advance when 50 or more workers will lose their jobs at a plant or office.

Nevertheless, before we highlight the recent, hot-off-our-printer, 1Q 2020 chart, let’s go back and revisit some of Coventry League’s prescient warnings and insights over the past year or so. It appears we were not wrong on anything, which is rare. Our typical accuracy is roughly 80%, which is noticeably better than what is generally considered to be really good and quasi-expert. Admittedly, the bar is not very high.1 One is considered a quasi-expert by being right about two-thirds of the time.

Future Proves Past

May 2019: Alert About 1Q 2019 WARN Notices in Northeast Ohio

On 07 May 2019, we shared the following on our LinkedIn page:

• In the first quarter of 2019: 10 notices, affecting 803 jobs.

• Notable layoffs so far in 2019: Schwebel Baking Company (its Solon baking and distribution center), General Motors (assembly plant in Lordstown), and Ferro Corporation (porcelain enamel business at E. 56th St.).

Coventry League’s LinkedIn Post (07 May 2019)

Our co-founder had this to say:

WARN-ing: This is just one of many data points to assess (locally and nationally) to keep a pulse on economic conditions. Naturally, we all realize that correlation does not imply causation. Let’s wait and see what Q2 and Q3 reveal.

Co-founder, Joe, shared our post and stated this

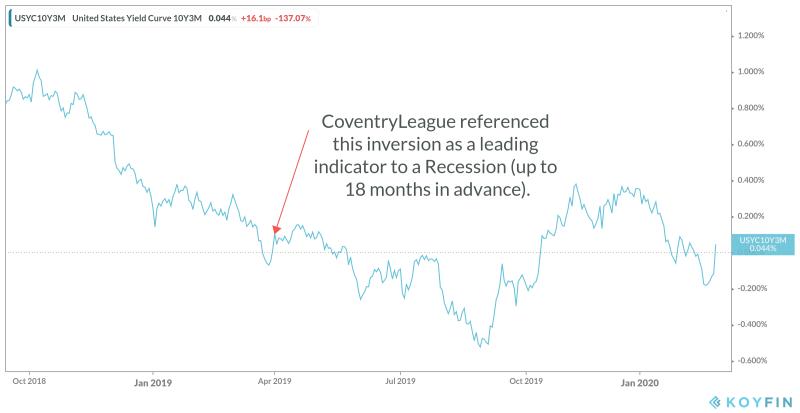

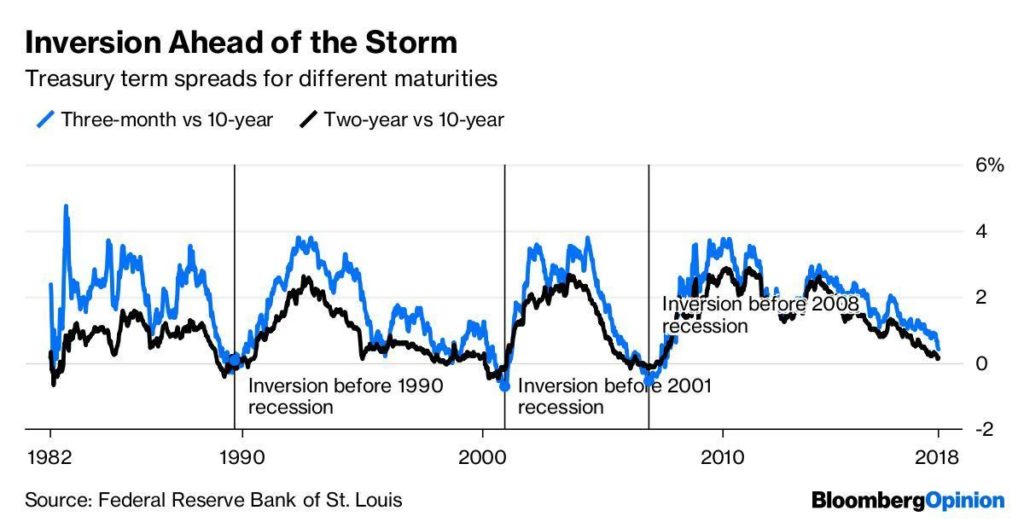

August 2019: Ominous Yield Curve Inversion

On 14 August 2019, Coventry League hinted at a recession occurring within 12-15 months and that facts and truth are not well-received by many people:

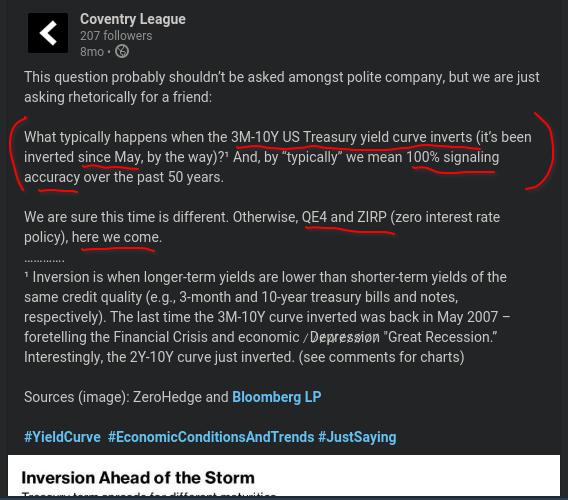

This question probably shouldn’t be asked amongst polite company, but we are just asking rhetorically for a friend:

What typically happens when the 3M-10Y US Treasury yield curve inverts (it’s been inverted since May, by the way)?¹ And, by “typically” we mean 100% signaling accuracy over the past 50 years.

We are sure this time is different. Otherwise, QE4 and ZIRP (zero interest rate policy), here we come.

Snippet from our Linked Post (14 August 2019)

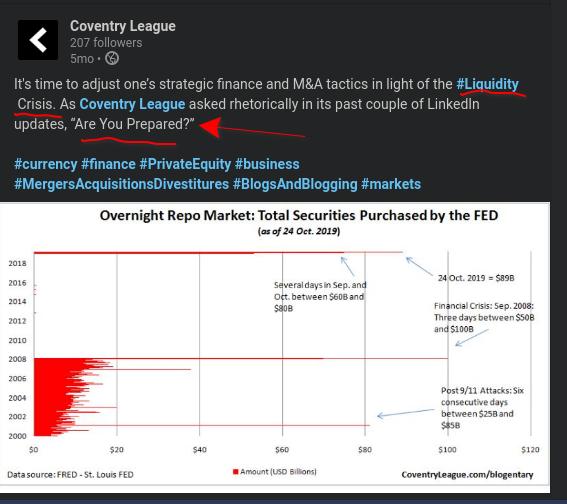

October 2019: Several Posts About Global Financial Crisis

Coventry League and Joe posted at least a half-dozen times suggesting we were in the initial stages of a global financial crisis worse than the 2008 financial crisis. Coventry asked, “Are You Prepared?” and the word “Depression” was used to indicate what to expect. Again, this was all being posted and stated while mainstream media, “experts,” and high-ranking politicians and executives were stating and arguing the opposite. Citizens need to really ask what is–and has been–going on.

It’s time to adjust one’s strategic finance and M&A tactics in light of the #Liquidity Crisis. As Coventry League asked rhetorically in its past couple of LinkedIn updates, “Are You Prepared?”

Snippet from our post (26 October 2019)

Joe also shared many penetrating posts at this time in October and thereafter.2 We might need to write a couple of separate posts to highlight these warnings about a financial crisis and the global reaction concerning coronavirus (Covid-19). Although Dr. Sucharit Bhakdi, Professor Emeritus of Medical Microbiology at the Johannes Gutenberg University Mainz has some thought-provoking opinions on the matter. Here’s one of his early posts about the early stages of the Global Financial Crisis:

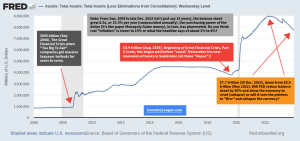

Early Tremblings of Financial Crisis 2.0? It’s probably nothing.

• Here’s what is currently happening: from early September 2019 until 16 October, the #FED increased its balance sheet by a whopping $253B! [FED Source: https://lnkd.in/eBQPFSr ]

• Quote from this article on Wall Street On Parade: “The Fed was a failed regulator in 2008 and it’s an even bigger failed regulator in 2019. To compensate for its own hubris, the Fed simply pumps out electronically created money to prop up a #banking structure that is as doomed today as it was in 2008.”

Snippet of Joe’s post (~16 October 2019)

Joe went on to post about the unraveling that most “fringe” financial bloggers were acknowledging and practically everyone else was either denying, covering-up, or both:

- October 2019: “Massive Liquidity Crisis, #Derivatives Implosion, and Bailouts? Link to, and extracts from, “Fed Ups Its Wall Street Bailout to $690 Billion a Week as Media Snoozes” at the #blog, Wall Street on Parade:” [Link to post]

- October 2019: “☞ Deutsche Bank, as of this morning, has a market cap of $15.81 billion and a derivatives book of $49 trillion notional (face amount) according to its 2018 annual report.” [Link to post]

- December 2019: Regarding states’ legalizing gold as legal tender/currency: “Will South Carolina become the fourth state to recognize #gold and #silver as legal tender? It appears we are getting closer to a tipping point. There’s clear momentum, that’s for sure.” [Link to post]

This brings us almost back to the future with our post earlier this year about mass layoffs in Ohio.

January 2020: Filings of WARN Notices In Ohio Surge ~50% in 2019

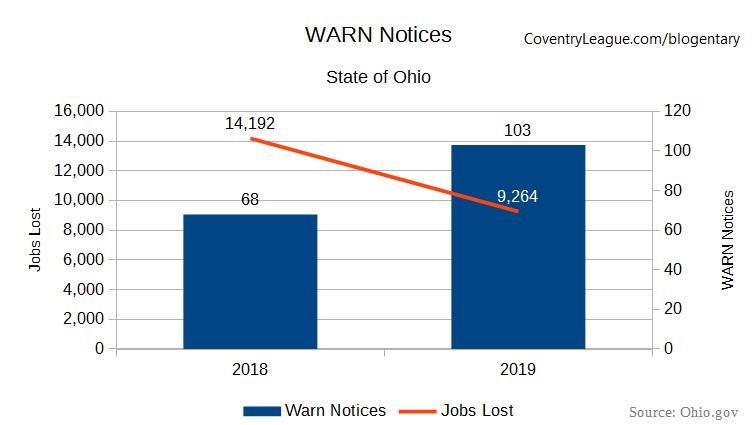

Coventry League wrote that the number of WARN Notices increased by 51% while the number of potential job losses decreased by 35%. This likely indicated smaller businesses were already feeling economic pain throughout 2019 (beginning at approximately end of 2018).

Coventry League posted about WARN¹ notices related to Northeast #Ohio back in May 2019 (see here https://lnkd.in/eEDEVWu and in comments). We now have full year 2019 data to compare to that of 2018.

✅ Good news (statewide): As the chart illustrates, the number of jobs lost related to WARN notices actually dropped by 35%.

❓ Hard to Interpret: However, the number of WARN notices submitted to the state in 2019 increased by 51% versus 2018. This might indicate more smaller and mid-size organizations filing notices. We will review notices again after Q1.

Snippet from our post (19 January 2020)

Back To The Future

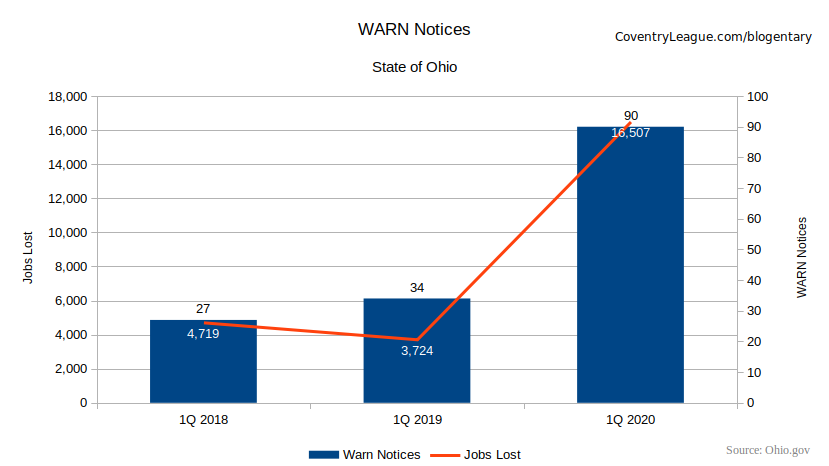

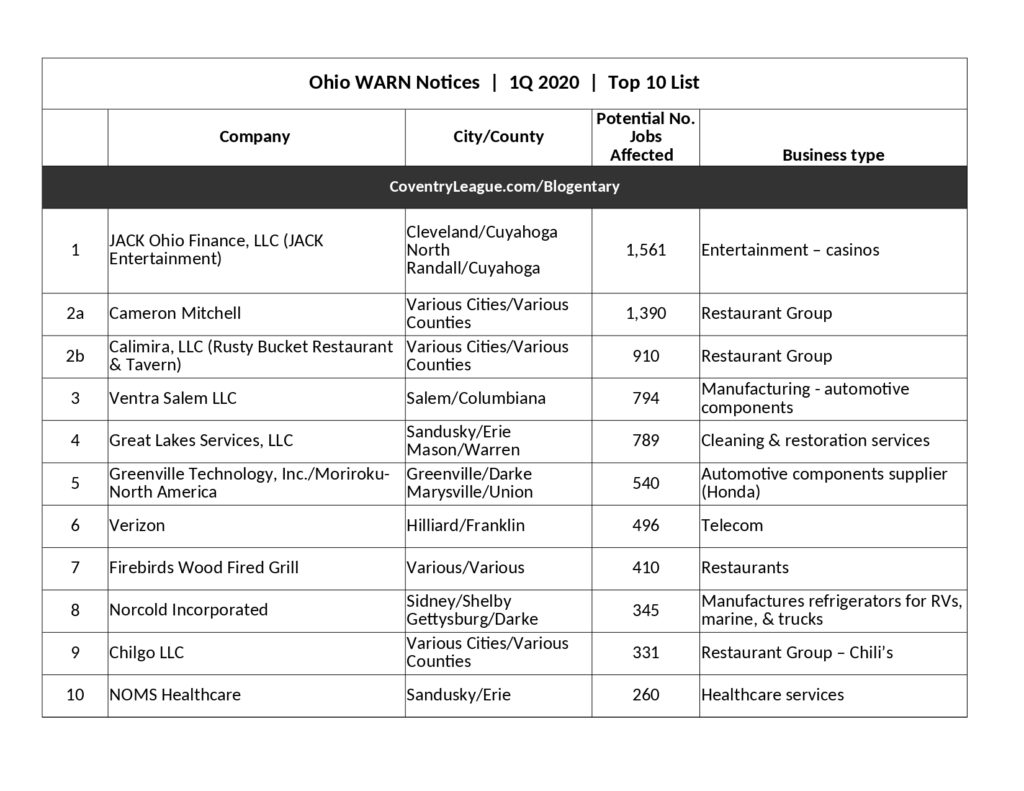

Now, here is the chart for mass layoffs in the state of Ohio for 1Q 2020. It depicts potential job losses due to mass layoffs reported in WARN Notices filed with the state.

Ohio’s 1Q 2020 WARN Notices

A quick glance indicates the following:

- 1Q 2019: WARN Notices increased by 26% versus same period prior year. This indicates filings of WARN Notices accelerated after 1Q since 2019 notices were up about 50% over 2018’s. Again, this suggests more smaller organizations might have been filing these notices since the number of potential jobs affected decreased.

- 1Q 2020: WARN Notices increased by a whopping 165% versus same period prior year. Moreover, the number of potential job losses surged by a startling 343%, which suggests some employer “Whales” laid-off a lot of employees in their WARN Notices.3 The state did footnote that some of the layoffs should be temporary, which is probably accurate. To what extent? That’s unclear.

Top 10 Organizations With Most Potential Job Losses

The organizations that are laying off the most people in 1Q 2020 in Ohio relate to casinos, restaurants, and automotive components companies.

We listed Cameron Mitchell and Calimira as 2a and 2b, respectively, because they are related organizations. Understanding this dynamic, this related restaurant group would be the number one organization for potential job losses in Ohio in 1Q 2020.

We are curious about number 10 on the list: NOMS Healthcare. Why would it be laying off in the middle of a pandemic? The other curious thing: NOMS states on its website that testing for Covid-19 is actually limited.

NOMS Healthcare is following the Ohio Department of Health’s guidance on who should be tested. This is a very limited population currently eligible for testing.

Posted on NOMS Healthcare website as of 01 April 2020

Closing Words

A key takeaway is that our economy and the global financial condition were deteriorating at an accelerating pace throughout 2019 culminating in massive bailouts in the last four months of 2019.

The attention and panic regarding the global Covid-19 pandemic have exacerbated an already challenging situation.

Book Suggestions

Given many people across the globe have been encouraged, or ordered, to stay at home, then here are some books you might want to consider reading, compliments of Helen Buyniski who shared the list and summaries of each in her article titled “Is it Brave New World or 1984? Here are a few dystopias we ALREADY live in.“

Of course, we would add at least one book by Aleksandr Solzhenitsyn, the author we referenced in our cover image. Perhaps a good choice would be The Gulag Archipelago 1918–1956 (abridged version) or One Day in the Life of Ivan Denisovich.4Some of his more recent nonfiction work has been banned in the Western World and has not been published entirely in English. Let’s just say he knew, and wrote, about the dangers of an all-too-powerful fake news, mainstream media propaganda machine.

One of Solzhenitsyn’s banned non-fiction/history books is ‘Two Hundred Years Together.’ A complete English copy that is not redacted is available on google drive:

https://drive.google.com/file/d/11FNFel27soj4Al5U1_u70wJgqsx0m0Uf/view?usp=sharing

Since the author’s death, one must find alternative means to the many redacted English versions.

Here’s an article that extends some of your points about books and the illogical hysteria about the coronavirus :

The Last Gasp, by Robert Gore

https://straightlinelogic.com/2020/03/24/the-last-gasp-by-robert-gore/