Mulberry St., New York, N.Y., 1900

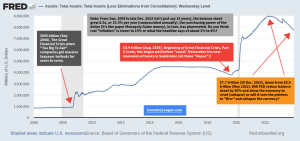

We wrote about the deflation versus inflation debate last year, and provided a couple of perspectives regarding how to frame, or define, the terms: namely, changes in money supply versus changes in nominal prices.

Today, Stoneleigh at The Automatic Earth provides a better and more detailed explanation in her post titled “Inflation for the Innocent, Hyperinflation for the Clueless.”

“It is not reality that drives markets, but perception, which is emotionally-driven rather than rational. If we assume markets will behave rationally, we will be wrong-footed every time.”

She also addresses the recent surge in commodities prices and acknowledges speculation, which is also described in this Bloomberg video about cotton hoarding in China.

“It is widely believed that the rise in commodity prices reflects the effects of China, India and other developing countries, but this long-term growth story certainly didn’t prevent commodities from collapsing in 2008. It’s a well-known result in resource economics that even when a resource is exhaustible and in significant demand, the price does not rise at a spectacular rate. Rather, except when there are new shocks that were previously unanticipated, the price of an exhaustible resource will tend to increase at roughly the rate of interest (Hotelling’s rule).”

Extract from:

March 7, 2011

“Quantitative Easing and the Iron Law of Equilibrium” by John P. Hussman, Ph.D.

The risk of rising oil is not a hyper inflationary spiral, but rather a deflationary spiral. Oil price increases are cost push inflation of the worst kind and for a country still mired in a balance sheet recession that means spending gets diverted which only gives the appearance of inflation in (highly visible) gas prices while creating deflationary trends in most (less visible) other assets (have a look at today’s Case Shiller housing report for instance).

Read more: https://www.creditwritedowns.com/2011/02/inflation-versus-deflation.html#ixzz1FJvYBzFU