Our U.S. dollar (USD) purchasing power is plummeting by the day, people!

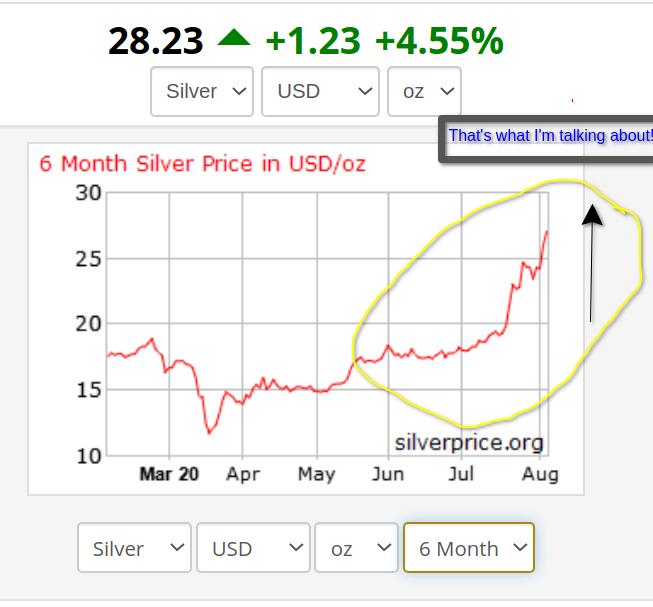

It seems like only yesterday that we could exchange $15 for an ounce of silver. Now, we need to exchange nearly $30 for an ounce of silver. Evidently, Yogi Berra was not wrong when he quipped, “a nickel ain’t worth a dime anymore.”

Will we see $50 per ounce soon? Coventry League has commented about gold and fiat currency in the past. The blog ZeroHedge also asked a similar question a week or so ago: “Which comes first: gold $3000 or silver $50 (thanks to @neelkashkari for making this question possible).”

Which comes first: gold $3000 or silver $50 (thanks to @neelkashkari for making this question possible). pic.twitter.com/7QRZ1fPsEU

— zerohedge (@zerohedge) July 27, 2020

Fortunately, at least half-dozen states have passed legislation recognizing gold and silver legal tender.

Top 6 States for Gold and Silver Legal Tender

| Rank | State | Year (legal) |

| 1. | Utah | 2011 |

| 2. | South Carolina | 2013 |

| 3. | Oklahoma | 2014 |

| 4. | Arizona | 2014 |

| 5. | Wyoming | 2018* |

| 6. | West Virginia | 2019 |

Utah, South Carolina, and Oklahoma have been the “gold standard” in setting legal precedent for returning to gold and silver legal tender. Congrats, by the way, to the newcomer on the list, “Take Me Home, Country Roads” West Virginia.

Song by John Denver

Closing Words

Are we missing a state that permits gold or silver legal tender? Let us know in the comments.

Via HackerNews: news.ycombinator DOT com/item?id=24313334

Person A: “Paper currency with real gold embedded in the notes:

goldback DOT com/ [sic]. The price is only 60% over spot.”

Person B: “Concise comment: Thanks for the tip about GoldBack dot com. It looks promising. ___

Long-winded comment: That article you shared references the “Utah Legal Tender Act in 2011.” According to the article shared by the Coventry League Blogentary, Utah is one of only six (6) states with gold/silver legal tender laws. The most recent state is West Virginia (2019).

Indeed, jurisdictions that enable a system – secondary or primary – that permits a free market for money/currency (paper/physical — such as the GoldBack or even digital) backed by publicly visible/verifiable stashes of physical gold/silver will be at a noticeable advantage to jurisdictions that only permit centrally-controlled currencies backed by the “full faith and credit” of the issuer (i.e, nothing; an ephemeral notion). This latter type of “fiat” currency has similarities to monopoly money with a central banker that controls the game (globally coordinated central banks peddling fiat like true charlatans, in our case).

Presently in Canada, the U.S., and some other jurisdictions, individuals may still legally own silver and gold coins to store a portion of their wealth.

For example, the government-issued Canadian Gold Maple Leaf coin has a face value of 50 CAN dollars but has a market-value of 1oz of gold (equivalent to about 2,500 CAN or 2,000 USD). Moreover, people are currently paying 10%-30% (or 60% as you mentioned) over this spot price to obtain these types of physical gold coins (or paper backed gold) in the secondary market.

Think of how the purchasing power of fiat currencies has plummeted over the years. One could walk around with a 1oz gold coin that is smaller than a U.S. metal dollar coin. However, the former has a purchasing power 2,000x that of the latter whereby it was only 35x just 50 years ago!

So, in one generation/lifetime (the last 50 years), the U.S. fiat dollar’s purchasing power relative to gold has plummeted by more than 98%!”