Contents

Questions to Consider

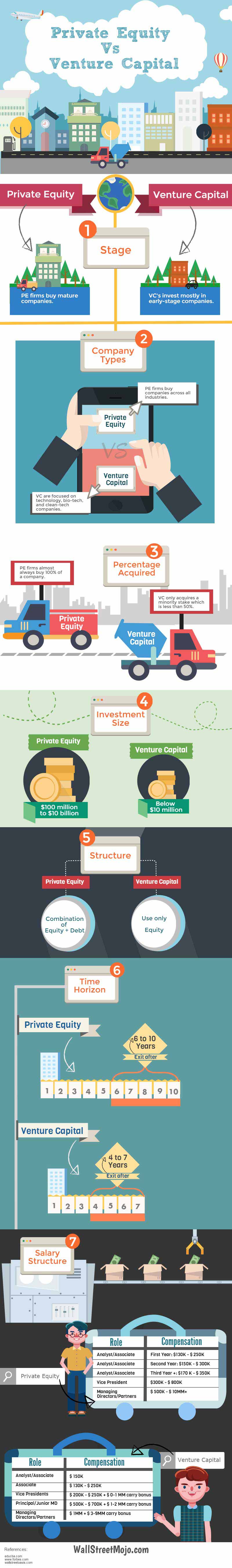

Have you ever wanted to know who to contact regarding acquisitions, divestitures, and structured finance services? What is the difference between late stage private equity and early stage venture capital? What is the preferred investment amount? Which firms have objective talent (unlevered returns over a business cycle, for example) and ability to perform as a principal and advisor/consultant? Do any gravitate towards businesses that embrace a social mission, sustainable growth, and accountability?

Where to Find Answers

Well, we have the answers to most of those questions. So, just ask us.

How to Obtain the List

Simply sign up (see that box to your right in the sidebar?) to Coventry League’s Email List and we will send you a complimentary curated list of Midwest-based firms engaged in private equity, venture capital, and M&A consulting!

To expedite our response to you: Use the online form on our Contacts page or send us a personal email to let us know about your interests, questions, and request.

What’s in it for You?

Subscribing to the email list is a great way to receive special discounts and incentives, actionable finance information, and new blog post announcements directly to your inbox!

What’s in it for Us?

We get to communicate directly with you to build a better relationship and network, personally respond to your interests, and perhaps even serve you one day.

Want More Finance Tools?

Visit the infographic below by WallStreetMojo and request some of its complimentary offerings including investment banking modeling, valuation, and private equity tools.

Note, however, we haven’t tried or reviewed the offerings. We found the infographic quite helpful, though. If you sample any of the tools or tips, then let us and the community know what you think in the comments below! And, of course, like or share this post so others may benefit from it.