Elsewhere, in contrast, leaders have been using fear-mongering and outright threats (if citizens don’t enable massive bailouts, then the equivalent of financial Armageddon will happen). The latter is disturbing because leaders are essentially saying if citizens don’t permit bailouts, then civil-servant leaders will make things worse than otherwise (drastically reduce public pensions, services, etc.). If these were company managers, their actions would be considered fraud by a rational Board of Directors and promptly removed from service.

A good example of the aforementioned fraud and potential fraud on citizens can be gleaned from what is happening in Greece. In short, Greece needs to restructure its debt; in other words, it needs to default. However, global banks and investors (take your pick) that speculated in credit default swaps, and international institutions (IMF, central banks) intend to do whatever it takes to prevent Greece from formally defaulting. The most recent ploy is to frame a default as a “voluntary exchange;” doing so is deemed to not trigger a payout by the sellers of CDS. However, a sovereign nation has no reason to play semantics with how it defaults, and is not beholden to sellers of CDS…unless there are implied threats against the country for doing what is best for its citizens.

So, as indicated in the blog by Automatic Earth titled “Honey, I Swapped the Greeks,” the concern is not with Greece defaulting and reducing the principal due to bondholders. Instead, the concern is with the huge payouts that would be required by CDS sellers (think insurance companies and banks; hedge funds; holding companies like Berkshire Hathaway; et al.)…and the money is not there to payout.

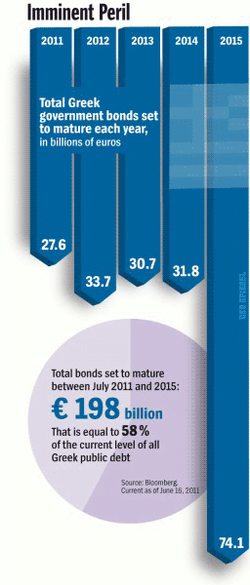

Total Greek bond market: $374B

Total Greek CDS market: $455B (ergo the problem with a formal default)

And, if Greece proceeds to formally default and not engage in semantics, then one can estimate the carnage from contagion of CDS payouts as defaults spread to larger sovereign nations that are in similar financial straits…

Iceland has stabilized its economy not by fear mongering but by the support of its citizen though the conditions looked critical but by letting the institution to default, it supported the citizen and received support in return.

Jim Rogers: “I shorted it [U.S. 30yr bond] June 10. I am short the US bond market as we speak.”

https://www.zerohedge.com/news/jim-rogers-us-has-already-lost-its-aaa-statusi-am-short-us-bond-market-we-speak

22 June 2011: https://www.telegraph.co.uk/finance/newsbysector/banksandfinance/8590428/Allied-Irish-Bank-has-defaulted-says-derivatives-body.html

“Banks that sold insurance on the debt of Allied Irish Banks will have to pay out to investors in the nationalised lender’s debt despite complex legal manoeuvres by the Irish authorities to avoid putting the lender into default.”