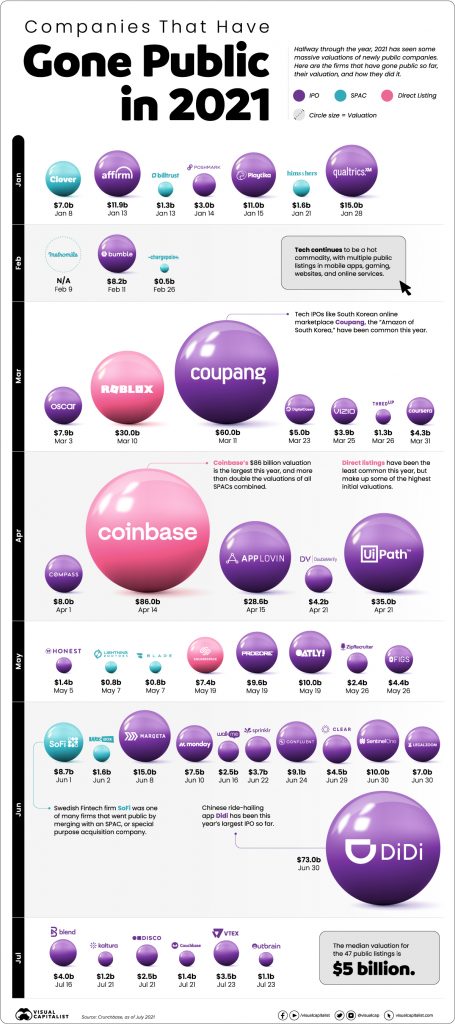

Below are 47 companies that have gone public via an initial public offering (IPO) through late July 2021. The format of the IPOs also includes SPACs (special purpose acquisition companies) and Direct Listings. Crunchbase provides a summary of each deal in its blog post titled, “Here’s Who’s Gone Public in 2021 (So Far).”

Can you identify any stock that is trading higher than its IPO valuation after three months from the IPO date? We leave it up to you to research that question and form a conclusion.

IPOs YTD 2021 | Inforgraphic

Below is the year-to-date (late July, as of this writing) infographic provided by VisualCapitalist of all the companies that have gone public in 2021 via an IPO.

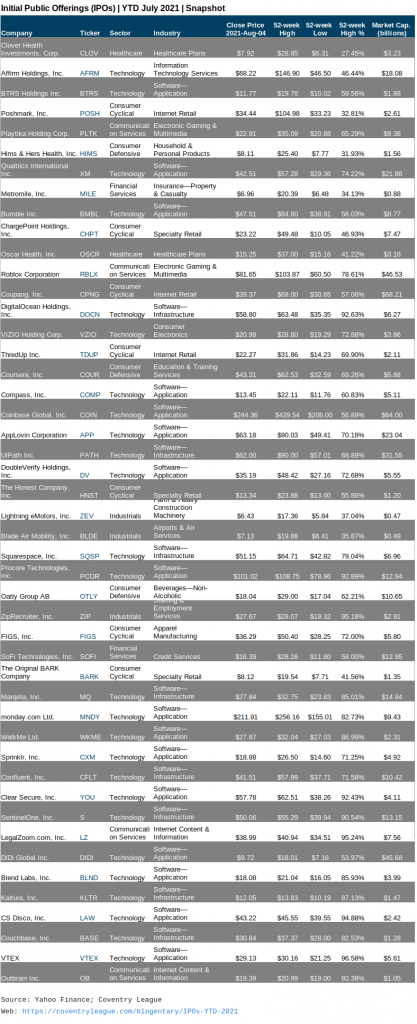

Market Capitalization – IPOs

We put the list of tickers in our trusty LibreOffice spreadsheet application and automatically pulled some basic trading data using a simple Python script.1As a reminder, we use Linux as our primary operating system (OS). It’s awesome! As you can see, many of the IPOs are trading well below their recent highs. We suspect very few are actually trading above their IPO valuations after three months of trading. We could be wrong, though. Let us know in the comments.

Closing Words

Although we write about capital raising (debt and equity), Coventry League doesn’t engage in capital raising mandates from an execution perspective for clients. We are asked about this a lot since some of us have experience in capital markets and on trading desks at large investment banks.

We are, however, a focused M&A and strategic finance advisory firm. The key word with respect to capital raising is “strategic.” We might, for instance, provide clients with insights about professional service providers (attorneys, accountants, sales & trading brokerages), market intelligence, and such. Of course, with respect to mergers, acquisitions, and divestitures (M&A), we provide both execution and strategic intelligence, especially with respect to buy-side, corporate development, and board of directors advisory.

Now you.

What is your thoughts about the valuations of the recent IPOs, especially the SPAC variant? Be frank, friends, like that of “Kuppy” Kupperman, founder of Praetorian Capital and Adventures in Capitalism, who recently shared a guest blog post on WolfStreet.com titled, “Ponzis Go Boom!!! – The SPAC market is in the process of detonating and it will take the Ponzi Sector with it.”

Let us know in the comments or on our LinkedIn page. And as always, reach out to us if you have questions about M&A and strategic finance, whether or not you’re just contemplating a strategic initiative in the near future or are just curious about your options some time down the road.

Thank you for sharing how your team compiled the data in the LibreOffice Calc spreadsheet using Python.

The link you provided is a really helpful resource for someone trying to learn Python scripts and even Pandas for data and financial analysis!

Financial Data from Yahoo Finance with Python” at CodingAndFun.com.

https://codingandfun.com/financial-data-from-yahoo-finance/