In a Wall Street Journal opinion article published last month, former high-yield corporate bond salesman and trader, Michael Milken, who has his share of detractors, penned an opinion titled Why Capital Structure Matters. He commented on this theme previously, including in a Forbes cover story titled My Story (March 16, 1992).2 Forbes has an alternative link here in which one may print the entire article, which we have done so for you.

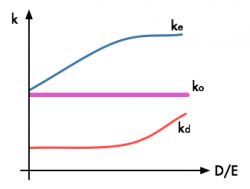

Milken stresses that an appropriate capital structure evolves and corporate leaders must consider various factors in managing it. Likewise, he provides recent examples (Alcoa and Johnson Controls) that deleveraging the capital structure of companies with uneven revenue streams can positively affect a company’s valuation, contrary to conventional financial theory.

He describes market signals that may prompt a CFO to consider modifying the capital structure. For instance, when equity market values surpass replacement value of assets, then deleveraging should occur, when practical.

According to the article, there were unwise modifications to the capital structures of AIG, Merrill Lynch, Washington Mutual, Home Depot and CBS, among others. What was the alleged error? They borrowed a lot of money to repurchase expensive common equity – some at peak 2007 values – equity that was more valuable than the underlying corporate assets.

Sramana Mitra provides a related article, among several others. Nevertheless, as Milken states, “It doesn’t matter whether a company is big or small. Capital structure matters. It always has and always will.”

Video: The Art and Science of Capital Structure (updated April 2015)

Key Points

- Too much leverage can leave an organization weaker than otherwise, just as avoiding debt at the wrong times can lead to missed opportunities for growth and job creation.

- Continually focusing on short-term financing reduces the amount of attention for longer-term planning.

- Finding the right capital structure is both an art and a science, and the best practitioners understand their environment and draw from a broad range of financial tools.

Have you read the Predators’ Ball